The global atrial fibrillation devices market size is estimated to rake around USD 37.84 billion by 2033 from USD 9.99 billion in 2023, growing at a CAGR of 14.25% from 2024 to 2033.

The Atrial Fibrillation Devices Market refers to the industry focused on the development, manufacturing, and distribution of medical devices used in the treatment and management of atrial fibrillation (AF), a common type of irregular heart rhythm. AF increases the risk of stroke, heart failure, and other heart-related complications. The market encompasses a wide range of devices, including catheter ablation systems, cardiac monitors, implantable devices such as pacemakers and defibrillators, and surgical devices used in AF procedures. With the rising prevalence of AF globally, the demand for effective treatment options and innovative devices continues to grow, driving the expansion of this market.

Key Points

- North America dominated the market with the largest market share of 37% in 2023.

- By device, the holter monitor segment has held the major market share of 43% in 2023.

- By application, the tachycardia segment dominated the market largest market share in 2023.

- By end-use, the hospitals and clinics segment has accounted more than 46% market share in 2023.

Growth Factors

Several factors contribute to the growth of the atrial fibrillation devices market. One significant factor is the increasing prevalence of atrial fibrillation worldwide. The aging population, sedentary lifestyles, and the prevalence of conditions such as obesity and hypertension contribute to the growing incidence of AF. As a result, there is a rising demand for devices that can effectively manage and treat AF, driving market growth.

Additionally, advancements in technology play a crucial role in driving market growth. Innovations such as minimally invasive procedures, improved catheter technologies, and the development of novel implantable devices have enhanced the efficacy and safety of AF treatments. These technological advancements attract both patients and healthcare providers, leading to increased adoption of AF devices and driving market expansion.

Furthermore, growing awareness among patients and healthcare professionals about the importance of early detection and treatment of AF contributes to market growth. Increased efforts in screening programs, educational initiatives, and campaigns to raise awareness about AF and its associated risks result in more individuals seeking diagnosis and treatment, thereby boosting the demand for atrial fibrillation devices.

Region Insights:

The atrial fibrillation devices market exhibits variations across different regions due to differences in healthcare infrastructure, regulatory frameworks, prevalence of AF, and adoption of advanced medical technologies. North America dominates the market, attributed to factors such as a large patient pool, high healthcare expenditure, and strong presence of key market players. The region benefits from early adoption of advanced medical technologies and favorable reimbursement policies, driving market growth.

Europe follows North America in market share, with countries like Germany, the UK, and France being significant contributors. The region’s well-established healthcare infrastructure, increasing prevalence of AF, and supportive government initiatives contribute to market growth. Asia Pacific is poised to witness rapid growth, driven by factors such as the growing elderly population, increasing awareness about AF, and rising healthcare expenditure in countries like China, India, and Japan.

In contrast, the market in regions like Latin America and the Middle East & Africa is relatively smaller but shows potential for growth. Factors such as improving healthcare infrastructure, rising disposable income, and increasing focus on improving cardiac care contribute to market expansion in these regions.

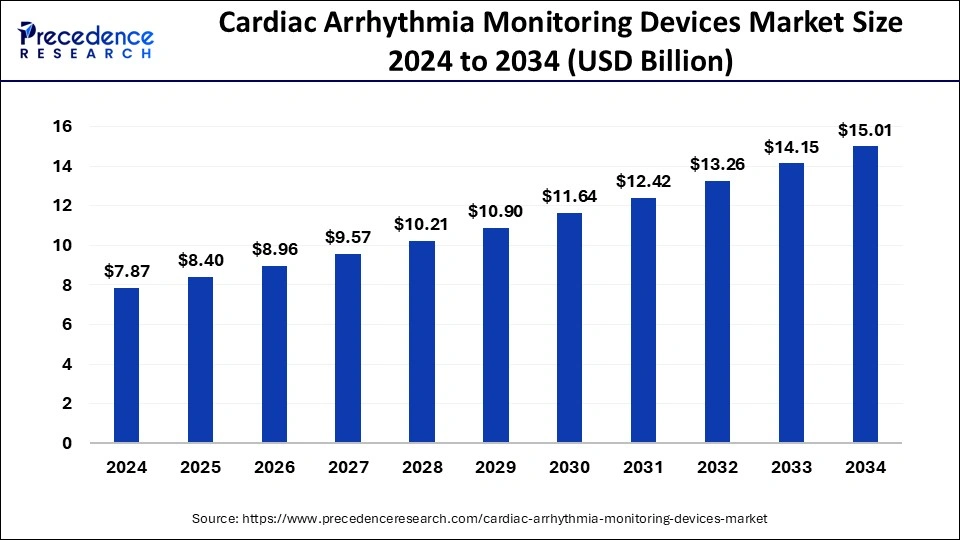

Cardiac Arrhythmia Monitoring Devices Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 6.74% |

| Global Market Size in 2023 | USD 7.37 Billion |

| Global Market Size by 2033 | USD 14.15 Billion |

| U.S. Market Size in 2023 | USD 2.05 Billion |

| U.S. Market Size by 2033 | USD 3.93 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Device, By Application, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Cardiac Arrhythmia Monitoring Devices Market Dynamics

Drivers

Several drivers propel the growth of the atrial fibrillation devices market. One of the primary drivers is the increasing prevalence of atrial fibrillation globally. As the population ages and the prevalence of risk factors such as obesity, hypertension, and diabetes rises, the incidence of AF is expected to increase, driving the demand for AF devices.

Technological advancements also drive market growth by improving the efficacy and safety of AF treatments. Innovations such as radiofrequency ablation, cryoablation, and advanced mapping systems enable more precise and effective treatment of AF, leading to increased adoption of AF devices.

Moreover, the growing emphasis on early detection and treatment of AF contributes to market growth. Awareness campaigns, screening programs, and initiatives to educate healthcare professionals and patients about the importance of managing AF effectively result in increased diagnosis and treatment rates, thereby boosting the demand for AF devices.

Opportunities:

The atrial fibrillation devices market presents several opportunities for growth and innovation. One opportunity lies in the development of novel technologies and devices for AF treatment. There is a growing demand for minimally invasive procedures and devices that offer better efficacy, safety, and patient outcomes. Companies investing in research and development to introduce novel catheter ablation systems, implantable devices, and monitoring technologies stand to capitalize on this opportunity.

Furthermore, expanding market penetration in emerging economies presents significant growth opportunities. As healthcare infrastructure improves, and disposable incomes rise in countries across Asia Pacific, Latin America, and the Middle East & Africa, there is an increasing demand for advanced cardiac care solutions, including AF devices. Companies can leverage these opportunities by expanding their presence in these regions and tailoring their products to meet the specific needs and preferences of local markets.

Additionally, collaborations and partnerships offer opportunities for market expansion. By forming strategic alliances with healthcare providers, research institutions, and other stakeholders, companies can enhance their product offerings, access new markets, and accelerate the adoption of AF devices.

Challenges

Despite the promising growth prospects, the atrial fibrillation devices market faces several challenges. One challenge is the stringent regulatory requirements governing the approval and commercialization of medical devices. Obtaining regulatory approvals can be a lengthy and costly process, delaying product launches and market entry.

Another challenge is the high cost associated with AF devices and treatments. Limited reimbursement coverage for certain procedures and devices can pose a barrier to adoption, particularly in regions with inadequate healthcare coverage or high out-of-pocket expenses for patients.

Moreover, competition within the market is intensifying, with several established players and new entrants vying for market share. Maintaining competitiveness requires continuous innovation, investment in research and development, and differentiation in product offerings.

Furthermore, disparities in healthcare access and awareness pose challenges to market growth, particularly in underserved regions. Addressing these disparities requires concerted efforts from healthcare organizations, governments, and industry stakeholders to improve access to healthcare services, raise awareness about AF, and promote preventive measures and early detection.

Read Also: Cardiac Arrhythmia Monitoring Devices Market Size, Report 2033

Recent Developments

- In November 2023, Medtronic introduced a heart implant to reduce the lifetime risk of stroke in patients with atrial fibrillation and improve the quality of life for patients undergoing open cardiac surgery.

- In January 2022, AliveCor, Inc. and Voluntis, a leading Aptar Pharma firm in digital therapies, have partnered to provide advanced management of atrial fibrillation for cancer patients.

Atrial Fibrillation Devices Market Companies

- Abbott Laboratories

- Johnson & Johnson

- Atricure Inc

- Microport Scientific Corporation

- Boston Scientific Corporation

- St. Jude Medical, Inc

- Medtronic Plc

- Koninklijke Philips N.V.

- Siemens AG

Segments Covered in the Report

By Product

- EP Ablation Catheters

- EP Diagnostic Catheters

- Mapping and Recording Systems

- Cardiac Monitors or Implantable Loop Recorder

- Access Devices

- Intracardiac Echocardiography (ICE)

- Left Atrial Appendage (LAA) Closure Devices

By End-use

- Hospitals

- Cardiac Centers

- Ambulatory Surgical Centers

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/

- Intelligent Traffic Management System Market Size, Trends, Report 2034 - July 17, 2024

- Healthcare Finance Solutions Market Size to Grow USD 293.12 Bn by 2034 - July 17, 2024

- Epoxy Composites Market Size to Grow USD 84.99 Bn by 2034 - July 17, 2024