Get a Sample:https://www.precedenceresearch.com/sample/3923

Growth Factors

Several factors contribute to the growth of the dental implants and abutment systems market. Firstly, the aging population worldwide has led to a higher incidence of tooth loss due to factors such as periodontal disease, decay, and trauma. As a result, there is a growing demand for dental implants as a long-term solution for replacing missing teeth and restoring oral health and function.

Moreover, technological advancements in dental implant materials, design, and fabrication techniques have improved the success rates and durability of implants, enhancing patient outcomes and satisfaction. The development of innovative materials such as titanium alloys, zirconia, and ceramic has expanded the range of options available to patients and clinicians, catering to diverse clinical needs and aesthetic preferences.

Additionally, increasing awareness about the benefits of dental implants and the availability of minimally invasive implant procedures have driven patient acceptance and adoption. Dental professionals are also incorporating digital technologies such as 3D imaging, computer-aided design and manufacturing (CAD/CAM), and guided surgery techniques to enhance treatment planning, accuracy, and patient comfort.

Trends:

The dental implants and abutment systems market is characterized by several key trends shaping the industry. One notable trend is the growing demand for immediate or same-day implants, where patients can receive implant placement and restoration in a single visit, reducing treatment time and improving patient convenience. This trend is driven by advancements in implant design, surgical techniques, and prosthetic workflows, enabling clinicians to achieve predictable outcomes with shorter turnaround times.

Another significant trend is the rise of digital dentistry, encompassing technologies such as intraoral scanners, cone-beam computed tomography (CBCT), and computer-guided implant placement. Digital workflows streamline treatment processes, from diagnosis and treatment planning to prosthetic fabrication and delivery, enhancing precision, efficiency, and patient communication.

Furthermore, there is a growing emphasis on aesthetic outcomes in implant dentistry, with patients seeking natural-looking restorations that blend seamlessly with their existing dentition. This trend has fueled the development of customized implant abutments, prosthetic materials, and digital smile design tools, allowing clinicians to achieve optimal esthetics and patient satisfaction.

Dental Implants and Abutment Systems Market Scope

| Report Coverage | Details |

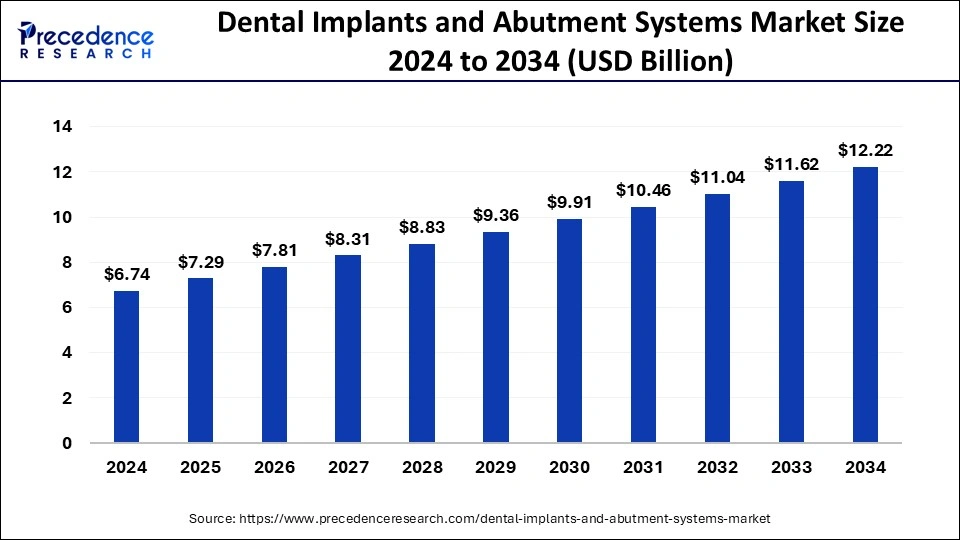

| Growth Rate from 2024 to 2033 | CAGR of 6.59% |

| Global Market Size in 2023 | USD 6.31 Billion |

| Global Market Size by 2033 | USD 11.95 Billion |

| U.S. Market Size in 2023 | USD 1.61 Billion |

| U.S. Market Size by 2033 | USD 3.05 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Material, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Region Insights:

The dental implants and abutment systems market exhibits regional variations influenced by factors such as healthcare infrastructure, reimbursement policies, and cultural preferences. North America and Europe are leading markets for dental implants, driven by high healthcare spending, advanced dental technologies, and a growing geriatric population.

In emerging markets such as Asia-Pacific and Latin America, rapid urbanization, rising disposable incomes, and increasing awareness about dental health are driving market growth. Countries like China, India, Brazil, and Mexico represent significant growth opportunities for dental implant manufacturers and suppliers, fueled by expanding dental tourism and government initiatives to improve oral healthcare access.

Competitive Landscape: The dental implants and abutment systems market is highly competitive, with a diverse range of players including dental implant manufacturers, dental laboratories, and dental implantologists. Key market players such as Straumann Group, Dentsply Sirona, Zimmer Biomet Holdings, and Nobel Biocare Holding AG dominate the global market, leveraging their extensive product portfolios, research and development capabilities, and global distribution networks.

Moreover, strategic partnerships, mergers and acquisitions, and product innovations are common strategies adopted by market players to gain a competitive edge and expand their market presence. For instance, recent collaborations between dental implant manufacturers and digital technology companies have resulted in integrated digital solutions for implant planning, surgical guides, and prosthetic design, offering comprehensive treatment solutions to dental professionals and patients.

Read Also: Genetic Analysis Market Size to Worth USD 23.60 Bn by 2033

Recent Developments

- In November 2023, Keystone Dental Holdings, a leader in dental implant technology, announced the commercial debut of the GENESIS ACTIVETM Implant System. This cutting-edge surgical technique will revolutionize the way dentists insert and restore implants.

- In September 2023, A pioneer in dental implant solutions, Neoss Group, is happy to announce the release of the latest Multi-Unit Abutment for its revolutionary Neoss4+ Treatment Solution. This system will revolutionize how dentists treat entire arch restorations. With the launch of the Neoss4+ and its ground-breaking Multi-Unit Abutment, Neoss is once more proving its dedication to improving dental implant technology and patient care.

Dental Implants and Abutment Systems Market Companies

- Ziacom

- Dentsply Sirona

- Envista Holdings Corporation

- Biocon LLC

- AB Dental Devices Ltd

- National Dentex Labs

- AVINENT Science and Technology

- Cortex

- Henry Schein Inc.

- Institut Straumann AG

- Osstem Implant Co., Ltd

- ZimVie Inc.

- Biotem

- Dentium

- Adin Dental Implant Systems Ltd.

- Keystone Dental Group

- Dentalpoint AG

- BHI Implants

- Ditron Dental

- Cowellmedi Co. Ltd

- TAV Dental

- Glidewell

- BioHorizons

- BioThread Dental Implant Systems

- Dynamic Abutment Solutions

Segments Covered in the Report

By Product

- Dental Implants

- Tapered Implants

- Parallel-walled Implants

- Abutment Systems

- Stock Abutments

- Custom Abutments

- Abutments Fixation Screws

By Material

- Titanium

- Zirconium

- Others

By End-use

- Hospitals

- Dental Clinics

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

- Intelligent Traffic Management System Market Size, Trends, Report 2034 - July 17, 2024

- Healthcare Finance Solutions Market Size to Grow USD 293.12 Bn by 2034 - July 17, 2024

- Epoxy Composites Market Size to Grow USD 84.99 Bn by 2034 - July 17, 2024