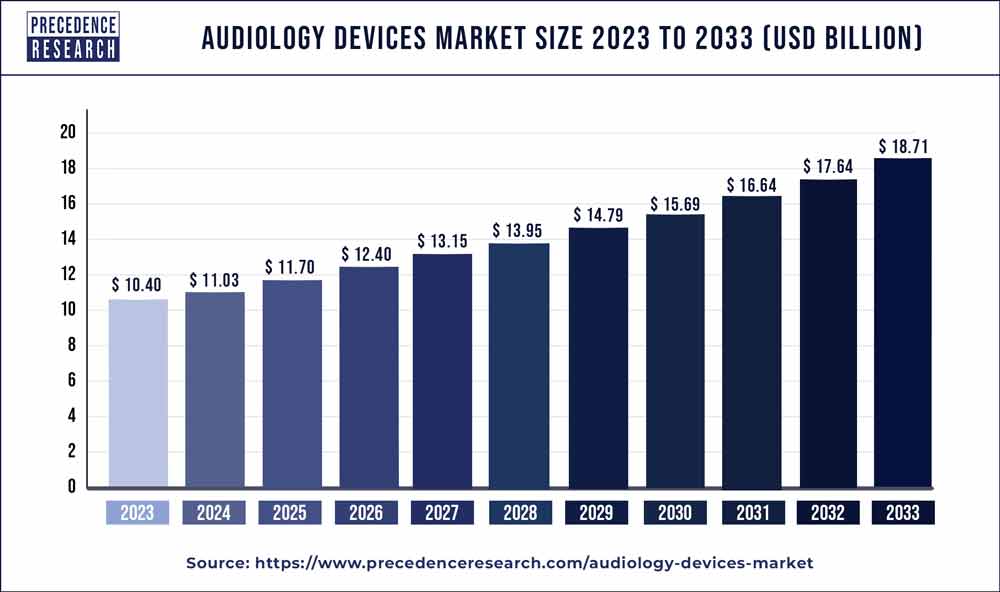

The global audiology devices market size is estimated to be worth around USD 18.71 billion by 2033 from USD 10.40 billion in 2023, growing at a CAGR of 6.04% from 2024 to 2033.

The audiology devices market is witnessing significant growth globally, driven by various factors such as the increasing prevalence of hearing loss, advancements in technology, growing awareness about hearing health, and rising geriatric population. Audiology devices encompass a wide range of products used for the diagnosis, treatment, and management of hearing and balance disorders. These devices play a crucial role in improving the quality of life for individuals affected by hearing impairment, ranging from mild to profound levels.

Key Points

- North America dominated the audiology devices market with a revenue share of 40% in 2023.

- By product, the hearing aids segment dominated the market with the largest share in 2023.

- By technology, the digital segment dominated the market with a revenue share of 93% in 2023.

- By sales channel, the retail sales segment has accounted revenue share of around 74.5% in 2023.

- By age group channel, the adult segment dominated the market with the largest share of 66.5% in 2023.

Get a Sample: https://www.precedenceresearch.com/sample/3909

Growth Factors

Several factors contribute to the growth of the audiology devices market. One of the primary drivers is the rising prevalence of hearing loss worldwide. According to the World Health Organization (WHO), around 466 million people globally suffer from disabling hearing loss, and this number is expected to increase significantly in the coming years due to factors such as aging populations, exposure to loud noise, and the prevalence of chronic diseases. As a result, there is a growing demand for audiology devices for early detection, diagnosis, and intervention.

Furthermore, technological advancements have revolutionized the audiology devices market, leading to the development of innovative and more efficient solutions. Digital hearing aids, cochlear implants, bone-anchored hearing systems, and assistive listening devices are some examples of advanced audiology devices that offer improved performance, comfort, and customization options for users. These technological innovations not only enhance the effectiveness of treatment but also expand the market by catering to diverse patient needs and preferences.

Region Insights

The audiology devices market exhibits a global presence, with key regions including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America dominates the market owing to factors such as a high prevalence of hearing loss, well-established healthcare infrastructure, technological advancements, and increasing healthcare expenditure. The presence of major market players and ongoing research and development activities further contribute to the region’s market dominance.

Europe is another significant market for audiology devices, driven by factors such as a growing geriatric population, increasing awareness about hearing health, and government initiatives to improve access to hearing healthcare services. Countries like Germany, the UK, and France are among the major contributors to the European audiology devices market, with a robust healthcare system and favorable reimbursement policies.

Asia Pacific is poised to witness rapid growth in the audiology devices market due to factors such as a large population base, rising disposable income, increasing healthcare spending, and improving healthcare infrastructure. Moreover, the prevalence of hearing loss is relatively high in countries like India and China, creating substantial market opportunities for audiology device manufacturers. Additionally, initiatives by governments and organizations to raise awareness about hearing health and provide access to affordable hearing care contribute to market growth in the region.

Latin America and the Middle East and Africa regions are also experiencing growth in the audiology devices market, driven by improving healthcare infrastructure, rising awareness about hearing health, and increasing adoption of advanced technologies. However, challenges such as limited access to healthcare services in remote areas and economic constraints may hinder market growth to some extent in these regions.

Audiology Devices Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 6.04% |

| Global Market Size in 2023 | USD 10.40 Billion |

| Global Market Size by 2033 | USD 18.71 Billion |

| U.S. Market Size in 2023 | USD 3.12 Billion |

| U.S. Market Size by 2033 | USD 5.61 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Technology, By Sales Channel, and By Age Group Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Audiology Devices Market Dynamics

Driver:

One of the key drivers of the audiology devices market is the increasing prevalence of hearing loss across all age groups. Hearing loss can result from various factors such as aging, genetic predisposition, exposure to loud noise, infections, ototoxic medications, and chronic diseases like diabetes and hypertension. With the aging population being particularly susceptible to hearing impairment, the growing geriatric population worldwide is fueling the demand for audiology devices. Additionally, the rising prevalence of risk factors such as noise-induced hearing loss among younger populations further contributes to market growth.

Moreover, the growing awareness about the importance of early detection and intervention for hearing loss is driving the demand for audiology devices. Educational campaigns, advocacy efforts by healthcare organizations, and government initiatives to promote hearing health screening and treatment have increased public awareness about hearing disorders and available treatment options. This heightened awareness encourages individuals to seek timely diagnosis and treatment, thereby boosting the uptake of audiology devices.

Opportunity:

The audiology devices market presents significant opportunities for market players to innovate and expand their product offerings. Technological advancements such as artificial intelligence (AI), machine learning, tele-audiology, and smartphone integration are transforming the landscape of audiology devices, offering new avenues for growth and differentiation. For example, AI-powered hearing aids can analyze environmental sounds in real-time and automatically adjust settings to optimize listening experiences for users. Similarly, tele-audiology platforms enable remote hearing assessments, consultations, and adjustments, enhancing accessibility to hearing healthcare services, especially in underserved areas.

Furthermore, expanding market penetration in emerging economies presents lucrative opportunities for audiology device manufacturers. Rapid urbanization, increasing healthcare infrastructure development, rising disposable incomes, and growing awareness about hearing health in countries like India, China, Brazil, and South Africa offer untapped market potential. By investing in market expansion strategies such as product localization, distribution partnerships, and awareness campaigns tailored to local needs, companies can capitalize on these emerging market opportunities.

Restraint:

Despite the positive growth prospects, the audiology devices market faces certain challenges that may restrain market growth. One of the primary restraints is the high cost associated with audiology devices, particularly advanced digital hearing aids and cochlear implants. Limited insurance coverage and reimbursement policies for hearing aids in some regions pose affordability barriers for patients, especially in low- and middle-income countries. Additionally, the lack of skilled healthcare professionals, particularly audiologists and hearing aid specialists, in certain regions may hinder the adoption of audiology devices and limit access to hearing healthcare services.

Furthermore, regulatory hurdles and compliance requirements pose challenges for market players in terms of product approval, registration, and market entry. Stringent regulatory standards and lengthy approval processes can delay product launches and increase development costs for manufacturers. Moreover, intellectual property rights issues, including patent disputes and counterfeit products, pose additional challenges to market players, affecting their market competitiveness and profitability.

Read Also: Urinary Catheters Market Size to Cross USD 10.15 Bn by 2033

Recent Developments

- In October 2022, the debut of Sony Electronics’ first over-the-counter (OTC) hearing aids for the US market was announced. Sony is redefining the market for hearing aids with an emphasis on customization, accessibility, and innovation.

Audiology Devices Market Players

- Demant A/S

- GN Store Nord A/S

- Sonova

- Starkey Laboratories, Inc.

- MAICO Diagnostics GmbH

- Oticon Medical

- INVENTIS srl

- MED-EL Medical Electronics

- Cochlear Ltd.

- WS Audiology A/S

Segments Covered in the Report

By Product

- Hearing Aids

- Cochlear Implants

- BAHA/BAHS

- Diagnostic Devices

By Technology

- Digital

- Analog

By Sales Channel

- Retail Sales

- E-commerce

- Government Purchases

By Age Group Channel

- Adults

- Pediatrics

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/

- Intelligent Traffic Management System Market Size, Trends, Report 2034 - July 17, 2024

- Healthcare Finance Solutions Market Size to Grow USD 293.12 Bn by 2034 - July 17, 2024

- Epoxy Composites Market Size to Grow USD 84.99 Bn by 2034 - July 17, 2024