Key Points

- North America dominated the medium-chain triglycerides market in 2023.

- By type, the caprylic acid segment held the largest share of the market in 2023.

- By source, the coconut oil segment held the largest share of the market in 2023.

- By application, the dietary and health supplements segment dominated the market with the largest market share in 2023.

Get a Sample: https://www.precedenceresearch.com/sample/3904

Growth Factors

Several factors contribute to the growth of the medium-chain triglycerides market. Firstly, the rising prevalence of obesity and lifestyle-related diseases has led to a surge in demand for healthier dietary options. MCTs are considered beneficial for weight management and metabolic health due to their ability to increase energy expenditure and promote satiety. As a result, consumers are increasingly incorporating MCT oil into their diets to support their weight loss goals and improve overall well-being.

Furthermore, the growing popularity of ketogenic diets has bolstered the demand for MCT products. Ketogenic diets, which are high in fat and low in carbohydrates, rely on MCTs as a source of energy since they can be rapidly converted into ketones by the liver. This has created a lucrative market opportunity for MCT oil manufacturers, as consumers seek out convenient and effective ways to maintain ketosis and support their ketogenic lifestyle.

Moreover, the expanding applications of MCTs in the food and beverage industry have contributed to market growth. MCT oil is often used as an ingredient in various functional food products, including energy bars, protein shakes, and meal replacement drinks. Its neutral flavor and ability to enhance texture and mouthfeel make it a versatile ingredient for formulating healthier and more indulgent food products. Additionally, MCT oil is increasingly being used in sports nutrition products to improve athletic performance and recovery.

Medium-chain Triglycerides Market Scope

| Report Coverage | Details |

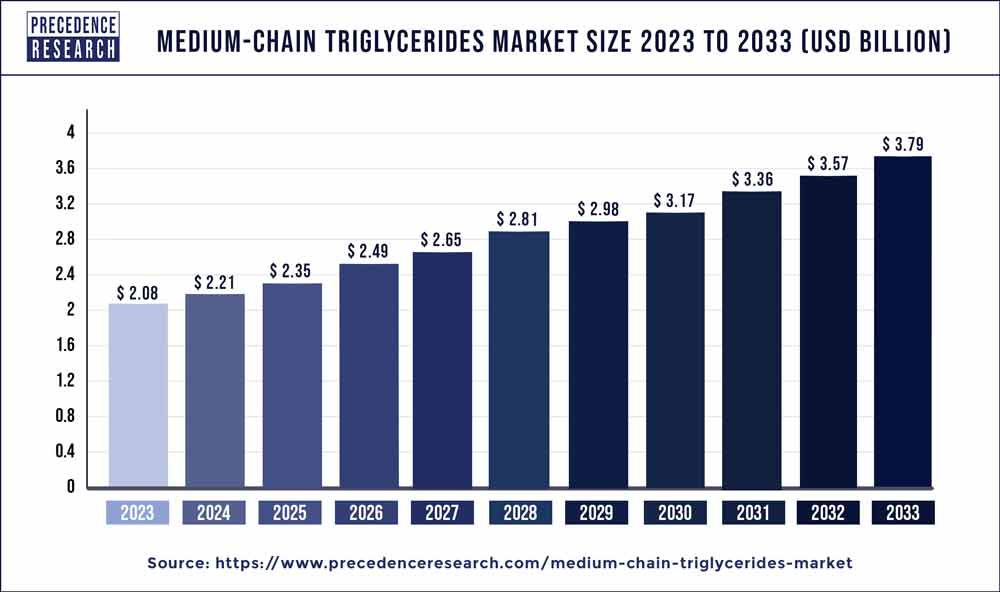

| Growth Rate from 2024 to 2033 | CAGR of 6.18% |

| Global Market Size in 2023 | USD 2.08 Billion |

| Global Market Size by 2033 | USD 3.79 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By Source, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Medium-chain Triglycerides Market Dynamics

Drivers

Several drivers are propelling the growth of the medium-chain triglycerides market. One of the key drivers is the growing consumer awareness regarding the health benefits of MCT oil. As more research highlights the potential therapeutic effects of MCTs, including their role in improving cognitive function, supporting heart health, and enhancing exercise performance, consumers are becoming increasingly interested in incorporating MCT products into their daily routines.

Moreover, the expanding retail presence of MCT oil products is driving market growth. MCT oil is now readily available in various retail channels, including supermarkets, health food stores, and online platforms. The convenience of purchasing MCT oil supplements and food products from these channels has made it more accessible to consumers, thereby fueling market demand.

Additionally, the rise of e-commerce platforms has significantly contributed to the growth of the MCT market. Online retailers offer a wide range of MCT oil products, allowing consumers to easily compare prices, read reviews, and make purchases from the comfort of their homes. The convenience and accessibility of online shopping have accelerated the adoption of MCT products among consumers, particularly those seeking personalized health solutions and specialty dietary supplements.

Restraints

Despite the positive growth outlook, the medium-chain triglycerides market faces certain restraints that could hinder its expansion. One of the primary challenges is the availability and cost of raw materials. Coconut oil and palm kernel oil, which are the primary sources of MCTs, are subject to price fluctuations and supply chain disruptions due to factors such as weather conditions, geopolitical tensions, and environmental concerns. This can impact the production costs and pricing of MCT oil products, potentially limiting market growth.

Moreover, regulatory constraints and labeling requirements pose challenges for MCT oil manufacturers and suppliers. In some regions, there may be strict regulations governing the labeling and marketing of dietary supplements and functional food products containing MCTs. Compliance with these regulations requires rigorous testing, documentation, and approval processes, which can increase the time and resources required to bring MCT products to market.

Furthermore, consumer perceptions and misconceptions about saturated fats and dietary oils could act as a barrier to market growth. While MCTs are generally considered safe and beneficial when consumed in moderation, there may be lingering concerns among some consumers regarding their impact on cholesterol levels and cardiovascular health. Educating consumers about the differences between various types of fats and oils, as well as the potential health benefits of MCTs, will be essential for overcoming these barriers and fostering greater acceptance and adoption of MCT products.

Opportunities

Despite the challenges, the medium-chain triglycerides market presents several opportunities for growth and innovation. One such opportunity lies in the development of novel MCT formulations and delivery systems. Manufacturers are increasingly investing in research and development to create MCT products with enhanced bioavailability, stability, and functionality. This includes microencapsulation techniques, nanoemulsion technology, and lipid-based delivery systems, which can improve the absorption and efficacy of MCTs in the body.

Moreover, there is a growing trend towards personalized nutrition and wellness solutions, driven by advances in digital health technologies and personalized diagnostics. This presents an opportunity for MCT oil manufacturers to develop tailored products and formulations that address specific health concerns and dietary preferences of individual consumers. By leveraging data analytics and predictive algorithms, companies can optimize their product offerings and marketing strategies to better meet the needs and preferences of their target audience.

Additionally, the expanding market for plant-based and vegan products represents a promising opportunity for MCT oil manufacturers. As consumers seek out sustainable and ethical alternatives to animal-derived ingredients, there is growing demand for plant-based MCT oils sourced from renewable sources such as algae, sunflower, and rapeseed. By catering to this trend and offering plant-based MCT options, manufacturers can tap into new market segments and differentiate themselves from competitors.

Furthermore, the increasing adoption of MCT oil in emerging markets presents untapped opportunities for market expansion. As disposable incomes rise and urbanization accelerates in developing countries, there is a growing awareness of health and wellness trends, driving demand for dietary supplements and functional food products. By establishing partnerships with local distributors and expanding their presence in key emerging markets, MCT oil manufacturers can capitalize on this growth potential and gain a competitive edge in the global market.

Read Also: Point-of-care Ultrasound Market Size to Rise USD 8.55 Bn by 2033

Recent Developments

- In July 2023, three professional athletes founded 4GOLD, a food technology firm, and together they introduced a new LiFT lipid supplement that combines medium-chain and long-chain triglycerides (MCTs) to provide a sustained energy release to support athletic performance.

Competitive Landscape

The medium-chain triglycerides market is characterized by intense competition among key players vying for market share and dominance. Major companies operating in the market include Nestlé S.A., Archer Daniels Midland Company, BASF SE, Wilmar International Limited, and Croda International Plc. These companies compete on the basis of product quality, innovation, pricing, distribution, and marketing strategies to gain a competitive advantage and strengthen their position in the market.

Moreover, the market is witnessing a proliferation of new entrants and startups offering innovative MCT products and formulations. These companies often focus on niche market segments or specialty applications, such as sports nutrition, ketogenic diets, and therapeutic nutrition. By leveraging their agility, creativity, and focus on customer needs, these startups pose a challenge to established players and contribute to market dynamism and innovation.

Additionally, strategic partnerships, collaborations, and acquisitions are prevalent in the medium-chain triglycerides market as companies seek to expand their product portfolios, geographical presence, and market reach. By forming alliances with ingredient suppliers, food manufacturers, and distribution partners, companies can enhance their capabilities, access new markets, and capitalize on emerging opportunities in the global MCT market.

Medium-chain Triglycerides Market Companies

- BASF SE

- DSM

- Croda International Plc.

- Sternchemie Lipid Technology

- KLK OLEO

- Wilmar International Limited

Segments Covered in the Report

By Type

- Caproic Acid

- Caprylic Acid

- Capric Acid

- Lauric Acid

By Source

- Palm Kernel Oil

- Coconut Oil

- Others

By Application

- Dietary & Health Supplements

- Personal Care & Cosmetics

- Pharmaceuticals

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

- Intelligent Traffic Management System Market Size, Trends, Report 2034 - July 17, 2024

- Healthcare Finance Solutions Market Size to Grow USD 293.12 Bn by 2034 - July 17, 2024

- Epoxy Composites Market Size to Grow USD 84.99 Bn by 2034 - July 17, 2024