The animal diagnostics market plays a critical role in ensuring the health and well-being of companion animals, livestock, and wildlife. Animal diagnostics encompass a wide range of tests, procedures, and technologies aimed at diagnosing diseases, monitoring health status, and guiding treatment decisions in animals. With the increasing importance of animal health for food safety, public health, and animal welfare, the demand for advanced diagnostic solutions continues to grow. This article explores the dynamics of the animal diagnostics market, including key growth factors, drivers, opportunities, restraints, and regional insights.

Key Points

- By region, North America dominated the animal diagnostics market in 2023.

- By region, Asia Pacific is expected to witness significant growth in the market during the forecast period.

- By product, the kits and reagent segment dominated the market in 2023.

- By product, the instruments segment is expected to grow in the market during the forecast period.

- By technology, the molecular diagnostics segment held the highest market share in 2023.

- By technology, the hematology segment is expected to grow at a significant rate in the market during the anticipated period.

- By animal type, the companion animals segment dominated the animal diagnostics market in 2023.

- By animal type, the livestock animals segment is expected to grow at a notable rate in the market during the predicted time period.

Get a Sample: https://www.precedenceresearch.com/sample/3894

Growth Factors

Several factors contribute to the growth of the animal diagnostics market. The rising incidence of infectious diseases, such as zoonotic diseases and emerging pathogens, underscores the need for accurate and timely diagnostic testing in animals. Additionally, the growing emphasis on preventive healthcare and disease surveillance in both companion animals and livestock drives the demand for diagnostic services and products. Technological advancements, including the development of rapid diagnostic tests, point-of-care devices, and molecular diagnostic techniques, further fuel market growth by enhancing diagnostic accuracy, efficiency, and convenience.

Moreover, increasing pet ownership rates, particularly in urban areas, drive demand for veterinary services, including diagnostics. As pets are increasingly regarded as family members, pet owners are willing to invest in advanced diagnostic procedures and treatments to ensure the health and well-being of their animals. Furthermore, regulatory initiatives aimed at improving animal health standards, such as mandatory testing for specific diseases and the implementation of traceability systems in livestock, drive adoption of diagnostic solutions across various regions.

Animal Diagnostics Market Scope

| Report Coverage | Details |

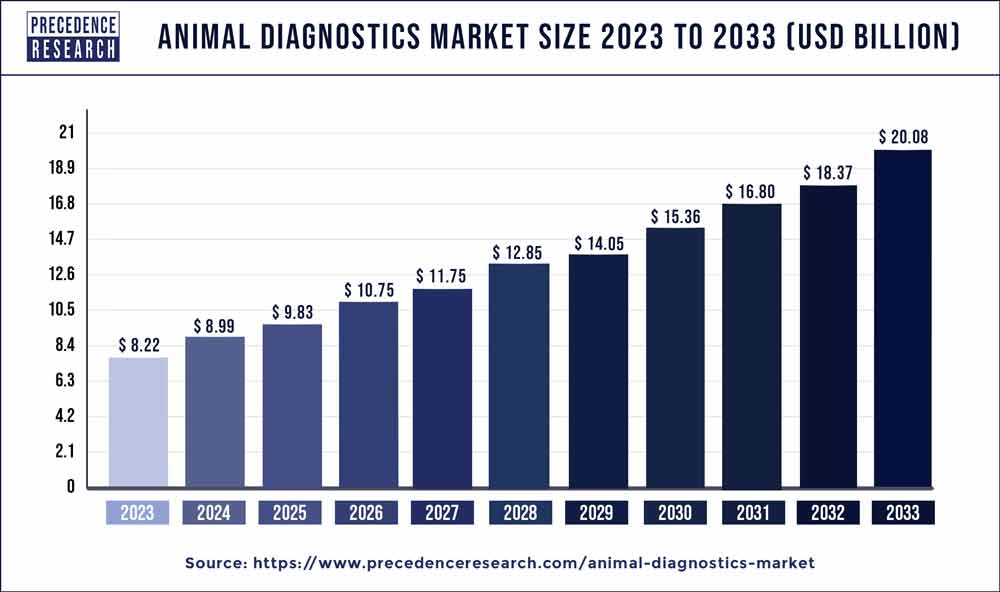

| Growth Rate from 2024 to 2033 | CAGR of 9.34% |

| Global Market Size in 2023 | USD 8.22 Billion |

| Global Market Size by 2033 | USD 20.08 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Technology, and By Animal Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Animal Diagnostics Market Dynamics

Drivers

Several drivers propel the growth of the animal diagnostics market. One key driver is the growing awareness of zoonotic diseases and the need for early detection and control measures to prevent their spread from animals to humans. Diseases such as avian influenza, rabies, and brucellosis highlight the interconnectedness of human and animal health, driving demand for diagnostic tests that can detect these pathogens in animals. Additionally, the increasing globalization of trade in animal products necessitates stringent surveillance and diagnostic testing to ensure food safety and prevent the spread of transboundary diseases.

Furthermore, advancements in biotechnology and genomics have led to the development of innovative diagnostic solutions, such as DNA-based tests and next-generation sequencing platforms, which offer greater sensitivity, specificity, and multiplexing capabilities. These technological advancements enable rapid and accurate detection of pathogens, genetic disorders, and drug resistance in animals, driving adoption among veterinarians, livestock producers, and wildlife conservationists. Moreover, the growing focus on precision livestock farming and personalized medicine in veterinary practice creates opportunities for tailored diagnostic solutions that optimize animal health outcomes and productivity.

Opportunities

The animal diagnostics market presents significant opportunities for innovation, expansion, and market penetration. The increasing demand for point-of-care testing solutions and mobile diagnostic platforms opens up new avenues for companies to develop portable, user-friendly devices that can be deployed in remote or resource-limited settings. Additionally, the integration of artificial intelligence and machine learning algorithms into diagnostic workflows holds promise for improving diagnostic accuracy, predictive modeling, and data analytics in animal health.

Furthermore, partnerships and collaborations between diagnostic companies, veterinary clinics, research institutions, and government agencies can facilitate knowledge sharing, technology transfer, and market access. For example, strategic alliances with pharmaceutical companies can enable diagnostic companies to leverage distribution networks and expand their product offerings, while collaborations with academic institutions can drive innovation and product development. Moreover, expansion into emerging markets, such as Asia-Pacific and Latin America, offers opportunities for growth due to increasing pet ownership rates, rising disposable incomes, and evolving regulatory landscapes.

Restraints

Despite the growth opportunities, the animal diagnostics market faces several challenges and restraints. Economic uncertainties, budget constraints, and cost considerations may limit investment in diagnostic services and products, particularly in regions with limited healthcare infrastructure and veterinary resources. Additionally, regulatory hurdles, such as complex approval processes and varying quality standards across different jurisdictions, can hinder market entry and product commercialization efforts.

Moreover, concerns related to data privacy, sample collection, and test accuracy may influence consumer perceptions and adoption rates of diagnostic technologies. Veterinary diagnostic tests often require specialized training and infrastructure for sample collection, handling, and interpretation, posing challenges in resource-limited or rural areas. Furthermore, market consolidation and competition from established players may create barriers to entry for new entrants and smaller companies, limiting innovation and market diversity.

Read Also: Pregnancy Medication Market Size to Attain USD 135.43 Bn by 2033

Regional Insights

The animal diagnostics market exhibits regional variations in terms of market size, growth potential, regulatory frameworks, and consumer preferences. North America and Europe dominate the market, driven by high pet ownership rates, advanced veterinary healthcare infrastructure, and stringent regulatory standards. The presence of key market players, research institutions, and academic centers of excellence further contributes to market growth and innovation in these regions.

In contrast, Asia-Pacific and Latin America represent emerging markets with significant growth opportunities fueled by increasing urbanization, rising disposable incomes, and expanding pet populations. Rapid urbanization and changing lifestyles drive demand for companion animal healthcare services and products, including diagnostic tests, vaccines, and pharmaceuticals. Moreover, government initiatives aimed at improving animal health standards, such as vaccination campaigns and disease surveillance programs, create opportunities for market penetration and partnerships with local stakeholders.

Recent Developments

- In February 2024, Tata Trusts is about to launch its first-of-a-kind small veterinary hospital in Mumbai, India. The hospital is on five floors and has a capacity of over 200 beds. It is a super specialty hospital for pets and will provide 24/7 services.

- In February 2024, MiDOG Animal Diagnostics LLC, a leading player in the microbiome veterinary diagnostic works on the Next Generation DNA Sequencing analysis, introduced a renewed branding strategy in 2024. The latest branding includes the acceptance of MiDOG’s technology for all animal species.

- In February 2024, IDEXX Laboratories, Inc., a leading player in pet healthcare innovations, announced the launch of the Vello, a software application that combines clients and veterinary practices through modern digital tools.

Animal Diagnostics Market Companies

- IDEXX Laboratories, Inc.

- Zoetis

- Antech Diagnostics, Inc. (Mars Inc.)

- Agrolabo S.p.A.

- Embark Veterinary, Inc.

- Esaote SPA

- Thermo Fisher Scientific, Inc.

- Innovative Diagnostics SAS

- Virbac

- FUJIFILM Corporation

Segments Covered by the Report

By Products

- Kits and Reagents

- Instruments

- Software and Services

By Technology

- Molecular Diagnostics

- Hematology

- Immunodiagnostics

By Animal Type

- Companion Animal

- Livestock Animal

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

- Intelligent Traffic Management System Market Size, Trends, Report 2034 - July 17, 2024

- Healthcare Finance Solutions Market Size to Grow USD 293.12 Bn by 2034 - July 17, 2024

- Epoxy Composites Market Size to Grow USD 84.99 Bn by 2034 - July 17, 2024