Key Points

- North America led the market with the biggest market share of 45% in 2023.

- Asia Pacific is projected to expand at the fastest rate during the forecast period of 2024-2033.

- By device type, the drug-coated balloons (DCBs) segment held the largest share of the market in 2023.

- By device type, the intravascular ultrasound (IVUS) catheter segment is expected to show the fastest growth.

- By application type, the peripheral artery disease segment held the dominating share of the market in 2023.

- By application type, the coronary artery disease segment represents another highly influential segment for the forecast period.

- By end-user, the cardiac catheterization labs segment held the dominating share of the market in 2023.

- By end-user, the interventional radiology departments segment is expected to witness a significant rate of expansion during the forecast period.

Get a Sample: https://www.precedenceresearch.com/sample/3901

Growth Factors

Several factors contribute to the growth of the Atherectomy Devices Market. The rising incidence of cardiovascular diseases, fueled by factors such as aging populations, sedentary lifestyles, and unhealthy dietary habits, is driving demand for effective treatment options. Atherectomy devices offer a minimally invasive alternative to traditional surgical procedures, reducing patient discomfort, recovery times, and healthcare costs. Moreover, technological innovations, such as the development of laser and rotational atherectomy systems, are enhancing the efficacy and safety of these devices, further driving market growth.

Additionally, increasing awareness about the importance of early detection and treatment of cardiovascular diseases, coupled with initiatives to improve healthcare infrastructure in emerging markets, is expanding the patient pool for atherectomy procedures. Furthermore, strategic collaborations and partnerships between medical device manufacturers and healthcare providers are facilitating market penetration and driving adoption rates. As a result, the Atherectomy Devices Market is poised for significant growth in the coming years.

Atherectomy Devices Market Scope

| Report Coverage | Details |

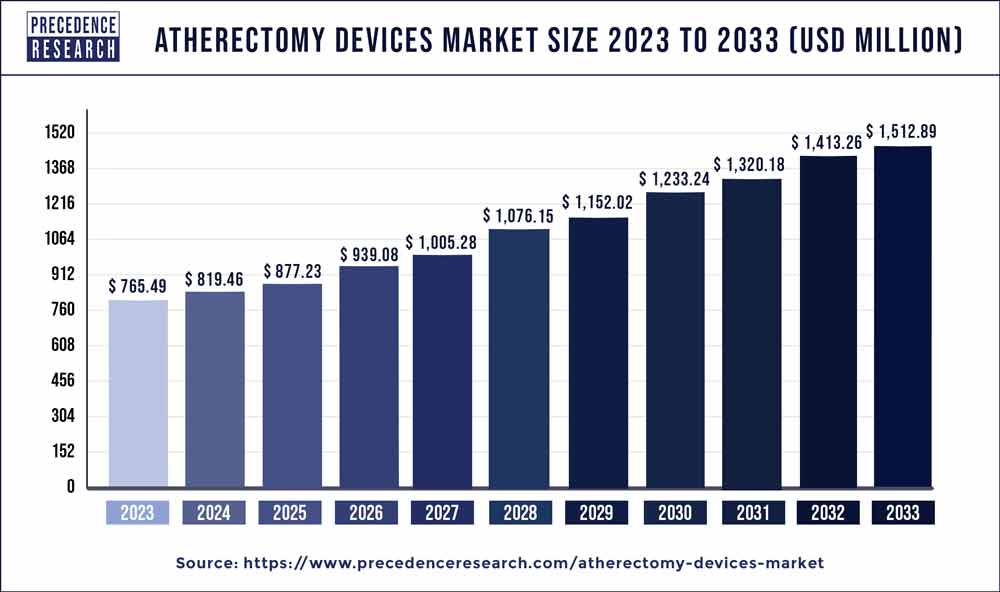

| Growth Rate from 2024 to 2033 | CAGR of 7.05% |

| Global Market Size in 2023 | USD 765.49 Million |

| Global Market Size by 2033 | USD 1,512.89 Million |

| U.S. Market Size in 2023 | USD 241.13 Million |

| U.S. Market Size by 2033 | USD 476.56 Million |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Devices Type, By Application, and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Atherectomy Devices Market Dynamics

Drivers

Several key drivers are shaping the growth trajectory of the Atherectomy Devices Market. Technological advancements in device design and functionality are enabling more precise and effective plaque removal, reducing the risk of complications and improving patient outcomes. For example, the development of catheter-based atherectomy systems with advanced imaging capabilities allows physicians to visualize plaque morphology and precisely target lesions, enhancing treatment accuracy.

Moreover, the shift towards outpatient procedures and same-day discharge protocols is driving demand for minimally invasive treatment options such as atherectomy, as these procedures offer shorter recovery times and lower hospitalization costs. Additionally, the growing prevalence of risk factors such as diabetes, obesity, and hypertension is increasing the demand for interventions to prevent and treat cardiovascular diseases, further driving market growth.

Furthermore, favorable reimbursement policies and regulatory initiatives aimed at promoting the adoption of innovative medical technologies are incentivizing healthcare providers to invest in atherectomy devices. For example, the expansion of insurance coverage for atherectomy procedures and the introduction of value-based payment models are facilitating greater access to these treatments, particularly among underserved patient populations.

Opportunities

The Atherectomy Devices Market presents numerous opportunities for growth and innovation. The increasing prevalence of cardiovascular diseases, particularly in emerging markets, offers a vast untapped market potential for device manufacturers. By expanding their presence in these regions and tailoring their product offerings to local needs and preferences, companies can capitalize on this growth opportunity and gain a competitive edge.

Moreover, advancements in imaging technologies, such as intravascular ultrasound (IVUS) and optical coherence tomography (OCT), present opportunities for the integration of real-time imaging guidance into atherectomy procedures, enhancing treatment precision and outcomes. Furthermore, the growing trend towards personalized medicine and targeted therapies opens up avenues for the development of next-generation atherectomy devices designed to deliver customized treatment strategies based on individual patient characteristics and disease severity.

Additionally, the increasing focus on preventive healthcare and lifestyle interventions presents opportunities for collaboration between medical device manufacturers, pharmaceutical companies, and healthcare providers to develop comprehensive treatment protocols that combine atherectomy with adjunctive therapies such as medication management, lifestyle modifications, and cardiac rehabilitation programs.

Restraints

Despite the promising growth prospects, the Atherectomy Devices Market faces certain restraints and challenges. One of the primary challenges is the high cost associated with atherectomy procedures, which can limit access to treatment, particularly in developing countries with limited healthcare budgets. Additionally, concerns about the long-term durability and effectiveness of atherectomy compared to other treatment modalities, such as balloon angioplasty and stenting, may hinder widespread adoption among physicians and patients.

Moreover, the complexity of atherectomy procedures and the specialized training required to perform them may pose barriers to adoption, particularly in settings where healthcare infrastructure and expertise are limited. Furthermore, regulatory hurdles and reimbursement challenges in certain regions can impede market entry and expansion for device manufacturers, requiring strategic planning and resource allocation to navigate.

Furthermore, competition from alternative treatment options, such as drug-eluting stents and bypass surgery, may limit market growth, particularly in cases where these interventions are perceived as more cost-effective or clinically superior. Additionally, concerns about procedural complications, such as vessel perforation or dissection, may deter physicians from adopting atherectomy devices, necessitating ongoing research and development efforts to enhance device safety and efficacy.

Read Also: Green Cement Market Size Will be USD 1,046.76 Million by 2033

Regional Insights

The Atherectomy Devices Market exhibits regional variations in terms of market size, growth trends, and regulatory environments. North America and Europe represent mature markets for atherectomy devices, characterized by high adoption rates, well-established healthcare infrastructure, and favorable reimbursement policies. However, market saturation and intense competition among device manufacturers may limit growth opportunities in these regions.

In contrast, Asia-Pacific and Latin America present lucrative growth opportunities for atherectomy device manufacturers, driven by factors such as rising healthcare expenditures, increasing prevalence of cardiovascular diseases, and improving access to advanced medical technologies. Moreover, government initiatives aimed at expanding healthcare coverage and upgrading healthcare infrastructure are creating conducive environments for market expansion in these regions.

Furthermore, the Middle East and Africa region is witnessing growing demand for atherectomy devices, fueled by factors such as improving healthcare access, rising disposable incomes, and increasing awareness about cardiovascular diseases. However, challenges such as regulatory complexities, infrastructure limitations, and socioeconomic disparities may hinder market growth in certain countries within this region.

Recent Developments

- In October 2023, Cardio Flow, Inc., announced U.S. Food and Drug Administration (FDA) 510(k) clearance for its FreedomFlow® Orbital Atherectomy Peripheral Platform.

- In September 2023, Avinger Inc., a commercial-stage medical device company, announced the full commercial launch of its Tigereye® ST next-generation image-guided chronic total occlusion (CTO) crossing system.

Atherectomy Devices Market Companies

- Abbott Laboratories

- Boston Scientific Corporation

- BD

- Cardinal Health Inc.

- Koninklijke Philips NV

- Medtronic Plc

- Terumo Corporation

- Avinger

- Cardiovascular Systems

- Ra Medical Systems

Segments Covered in the Report

By Devices Type

- Atherectomy Devices

- Angioplasty Balloon Catheters

- Stents (Bare-Metal, Drug-Eluting, Bioresorbable)

- Intravascular Ultrasound (IVUS) Catheters

- Optical Coherence Tomography (OCT) Catheters

- Drug-Coated Balloons

- Embolic Protection Devices

- Thrombectomy Devices

- Aortic Stent Grafts

- Endovascular Grafts

- Laser Atherectomy Devices

- Orbital Atherectomy Systems

- Rotational Atherectomy Devices

- Directional Atherectomy Devices

- Chronic Total Occlusion (CTO) Devices

By Application

- Peripheral Artery Disease (PAD) Treatment Devices

- Coronary Artery Disease (CAD) Intervention Devices

- Carotid Artery Disease Intervention Devices

- Renal Artery Disease Intervention Devices

- Aortic Atherosclerosis Intervention Devices

By End-user

- Cardiac Catheterization Labs

- Interventional Radiology Departments

- Vascular Surgery Centers

- Cardiology Clinics

- Academic Research Institutions

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

- Intelligent Traffic Management System Market Size, Trends, Report 2034 - July 17, 2024

- Healthcare Finance Solutions Market Size to Grow USD 293.12 Bn by 2034 - July 17, 2024

- Epoxy Composites Market Size to Grow USD 84.99 Bn by 2034 - July 17, 2024