The pharmaceutical unit-dose packaging market has witnessed significant growth in recent years, driven by the rising demand for convenient and safe packaging solutions in the pharmaceutical industry. Unit-dose packaging refers to the packaging of a single dose of medication or pharmaceutical product in a pre-measured quantity, intended for individual use. This packaging format offers numerous advantages, including improved medication adherence, reduced medication errors, and enhanced product protection against contamination and tampering. As pharmaceutical companies increasingly prioritize patient safety and compliance, the adoption of unit-dose packaging solutions has become integral to their packaging strategies.

Key Points

- North America held the largest market share of 34% in 2023.

- Asia Pacific is observed to witness the fastest rate of expansion during the forecast period.

- By material, the plastic segment dominated the market with the highest revenue share of 48% in 2023.

- By material, the glass material segment holds a significant share of the market.

- By product type, the vials segment has captured the largest market share of 30% in 2023.

- By product type, the blisters segment is observed to witness the fastest rate of expansion during the forecast period.

- By end-use, the oral segment dominated the market in 2023.

Get a Sample: https://www.precedenceresearch.com/sample/3896

Growth Factors

Several factors contribute to the growth of the pharmaceutical unit-dose packaging market. Firstly, the growing emphasis on patient-centric healthcare approaches and the need to improve medication adherence among patients with chronic diseases are driving the demand for unit-dose packaging solutions. These packages offer convenient dosing schedules and reduce the risk of medication errors, particularly among elderly and pediatric patients. Additionally, stringent regulatory requirements and quality standards imposed by regulatory bodies such as the FDA and EMA further propel the adoption of unit-dose packaging, as it helps pharmaceutical companies ensure compliance with regulatory guidelines and maintain product integrity throughout the supply chain.

Moreover, advancements in packaging technologies, such as the development of barrier materials and tamper-evident designs, enhance the safety and security of unit-dose packaging, thereby boosting its acceptance in the pharmaceutical industry. Furthermore, the increasing prevalence of chronic diseases, coupled with the growing demand for personalized medicines and specialty pharmaceuticals, drives the demand for unit-dose packaging formats tailored to specific dosage requirements and patient preferences. As pharmaceutical manufacturers seek to differentiate their products and enhance brand loyalty, they are increasingly investing in innovative unit-dose packaging solutions that offer convenience, safety, and differentiation in the market.

Pharmaceutical Unit-dose Packaging Market Scope

| Report Coverage | Details |

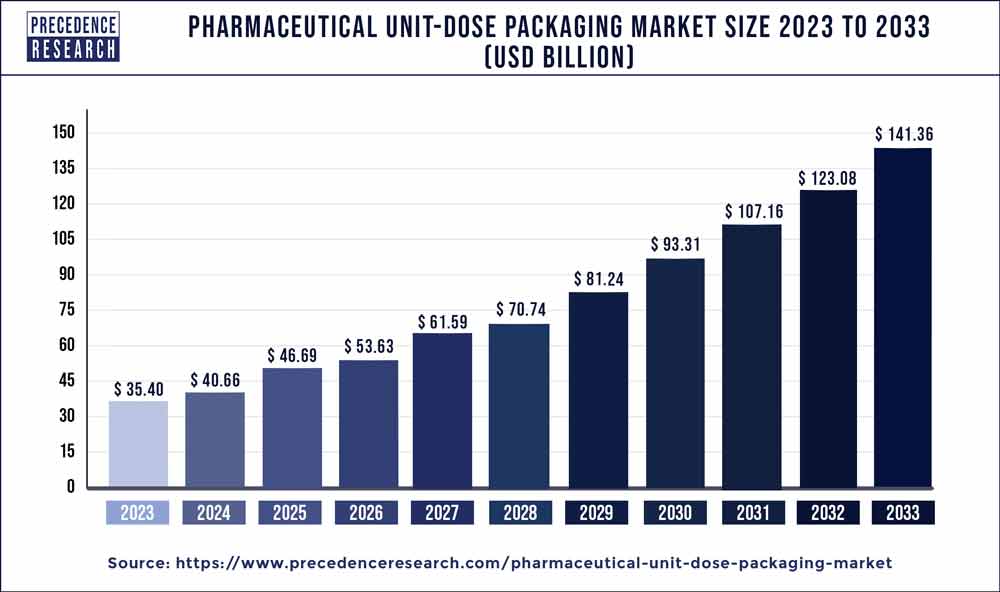

| Growth Rate from 2024 to 2033 | CAGR of 14.85% |

| Global Market Size in 2023 | USD 35.40 Billion |

| Global Market Size by 2033 | USD 141.36 Billion |

| U.S. Market Size in 2023 | USD 8.43 Billion |

| U.S. Market Size by 2033 | USD 33.64 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Material, By Product, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Pharmaceutical Unit-dose Packaging Market Dynamics

Drivers:

Several key drivers are expected to fuel the growth of the pharmaceutical unit-dose packaging market in the foreseeable future. Firstly, the global population is aging rapidly, leading to a higher incidence of chronic diseases and age-related health conditions. As a result, there is a growing need for medications that are easy to use and administer, particularly among elderly patients who may have difficulty managing complex medication regimens. Unit-dose packaging addresses this need by providing pre-measured doses of medication in easy-to-open packages, thereby improving medication compliance and patient outcomes.

Furthermore, the increasing prevalence of counterfeit drugs and the need to combat medication counterfeiting drive the adoption of unit-dose packaging solutions with advanced security features such as holographic labels, RFID tags, and serial numbers. These anti-counterfeiting measures help pharmaceutical companies safeguard their products against tampering, adulteration, and diversion, thereby protecting patient safety and brand reputation. Additionally, the rise of e-commerce in the pharmaceutical sector and the growing demand for home healthcare services create new opportunities for unit-dose packaging manufacturers to develop convenient and portable packaging solutions suitable for online retail and direct-to-patient distribution channels.

Restraints:

Despite the promising growth prospects, the pharmaceutical unit-dose packaging market faces certain challenges that may impede its growth trajectory. One of the primary restraints is the high initial investment required for implementing unit-dose packaging systems and acquiring specialized packaging equipment. Small and medium-sized pharmaceutical companies, in particular, may find it financially burdensome to transition from traditional packaging formats to unit-dose packaging solutions, thereby limiting market penetration.

Moreover, concerns regarding the environmental sustainability of single-use packaging formats, including unit-dose packaging, have emerged as a significant restraint in recent years. The proliferation of plastic packaging materials and the generation of packaging waste contribute to environmental pollution and raise questions about the long-term sustainability of current packaging practices. As a result, pharmaceutical companies are under increasing pressure to adopt eco-friendly packaging alternatives and implement recycling and waste reduction initiatives to minimize their environmental footprint.

Additionally, regulatory compliance and quality assurance requirements pose challenges for pharmaceutical manufacturers seeking to implement unit-dose packaging solutions. Ensuring compliance with strict regulatory guidelines and maintaining product safety and efficacy throughout the packaging process require substantial investments in quality control measures, validation studies, and staff training. Non-compliance with regulatory standards can result in product recalls, fines, and reputational damage, posing a significant risk for pharmaceutical companies operating in highly regulated markets.

Opportunities:

Despite the challenges, the pharmaceutical unit-dose packaging market presents lucrative opportunities for growth and innovation. The increasing adoption of digital technologies such as smart packaging solutions, RFID-enabled tracking systems, and augmented reality applications opens up new possibilities for enhancing the functionality and user experience of unit-dose packaging. These technologies enable real-time monitoring of medication adherence, remote patient monitoring, and personalized dosage reminders, thereby improving patient engagement and treatment outcomes.

Furthermore, the expansion of pharmaceutical markets in emerging economies, coupled with rising healthcare expenditure and improving access to healthcare services, creates new opportunities for unit-dose packaging manufacturers to tap into untapped market segments and expand their global footprint. As governments and regulatory agencies in developing countries strengthen their regulatory frameworks and quality standards for pharmaceutical packaging, the demand for safe and reliable unit-dose packaging solutions is expected to surge, driving market growth in these regions.

Moreover, strategic collaborations and partnerships between pharmaceutical companies, packaging manufacturers, and technology providers facilitate knowledge exchange, innovation, and market expansion. By leveraging each other’s expertise and resources, industry stakeholders can develop customized unit-dose packaging solutions tailored to specific therapeutic areas, patient populations, and market segments, thereby gaining a competitive edge in the global pharmaceutical packaging market.

Read Also: IT Devices Market Size to Rake USD 4,436.53 Bn by 2033

Recent Developments

- In December 2023, Sun Pharmaceutical Industries Ltd launched the ‘es-omeprazole’ the chiral version of the anti-ulcerant drug omeprazole. This version of the medicine is lesser in side effects and is considered more efficient than the molecule itself.

- In 2023, Gerresheimer Gx Solutions is designing packaging solutions for complex injectable drugs. Gerresheimer Gx Solutions working on the primary packaging solution for sensitive injectable drugs. The organization integrated expertise in the specialized team known as Gx Solutions.

- In January 2024, a clean technology company “Loop Industries”, launched the latest pharmaceutical packaging bottles in partnership with Bormioli Pharma. The bottle is made up of 100% recycled virgin quality Loop polyethylene terephthalate (PET) resin.

Competitive Landscape:

The pharmaceutical unit-dose packaging market is characterized by intense competition and a diverse vendor landscape comprising multinational corporations, medium-sized enterprises, and regional players. Leading pharmaceutical packaging companies such as Amcor plc, Becton, Dickinson and Company, Gerresheimer AG, and West Pharmaceutical Services, Inc., dominate the market with their extensive product portfolios, global presence, and strong distribution networks. These companies invest heavily in research and development activities to innovate and introduce new packaging solutions that meet evolving customer needs and regulatory requirements.

Furthermore, the market is witnessing increasing consolidation activities, with major players acquiring smaller packaging companies and technology startups to expand their product offerings and market reach. In addition to traditional packaging manufacturers, technology companies specializing in smart packaging solutions, serialization software, and track-and-trace systems are entering the pharmaceutical packaging market, intensifying competition and driving technological innovation. As competition intensifies, market players are focusing on product differentiation, cost optimization, and strategic alliances to gain a competitive advantage and sustain their market position in the rapidly evolving pharmaceutical unit-dose packaging market.

Pharmaceutical Unit-dose Packaging Market Companies

- Pfizer Inc

- Bristol-Myers Squibb Company

- Merck & Co. Inc.

- AbbVie Inc.

- Gerresheimer AG

- Comar LLC

- Amcor Plc.

- Johnson & Johnson

- UDG Healthcare Plc

- Berry Global, Inc.

Segments Covered in the Report

By Material

- Plastics

- Glass

- Paper and Paperboard

- Metal

By Product

- Vials

- Syringe and cartridge

- Ampoules

- Blisters

By End-use

- Ophthalmic

- Injectable

- Biologics

- Wound Care

- Respiratory Therapy

- Orals

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

- Intelligent Traffic Management System Market Size, Trends, Report 2034 - July 17, 2024

- Healthcare Finance Solutions Market Size to Grow USD 293.12 Bn by 2034 - July 17, 2024

- Epoxy Composites Market Size to Grow USD 84.99 Bn by 2034 - July 17, 2024