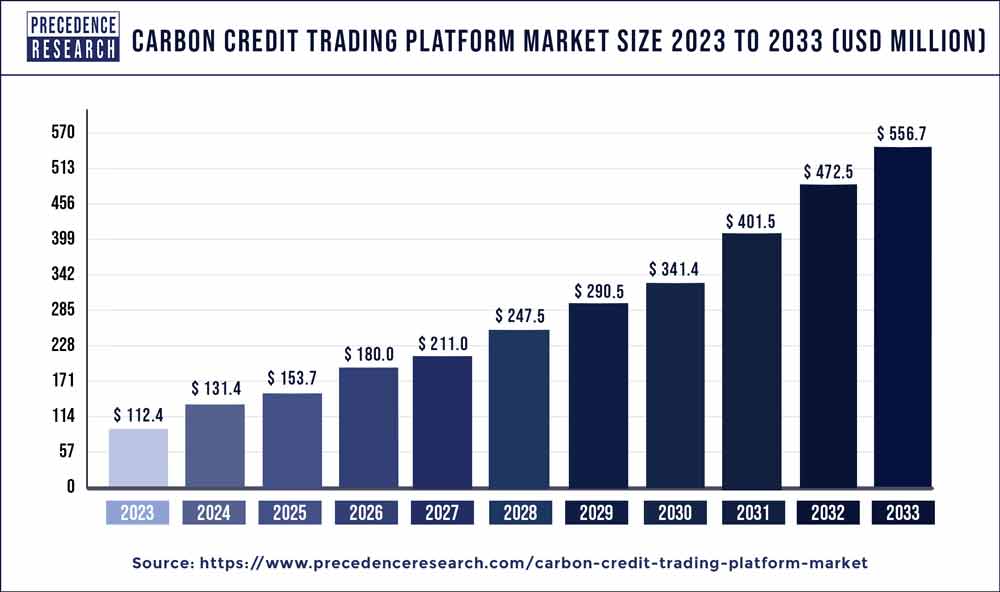

The global carbon credit trading platform market size is projected to hit around USD 556.7 million by 2033 from USD 112.4 million in 2023, growing at a CAGR of 17.40% from 2024 to 2033.

Key Takeaways

- Europe contributed 40% of market share in 2023.

- North America is estimated to expand the fastest CAGR between 2024 and 2033.

- By type, the voluntary segment has held the largest market share of 55% in 2023.

- By type, the compliance segment is anticipated to grow at a remarkable CAGR of 18.7% between 2024 and 2033.

- By system type, the cap trade segment generated over 57% of market share in 2023.

- By system type, the baseline and credit segment is expected to expand at the fastest CAGR over the projected period.

- By end-use, the utilities segment generated over 26% of market share in 2023.

- By end-use, the aviation segment is expected to expand at the fastest CAGR over the projected period.

Introduction:

The Carbon Credit Trading Platform Market has emerged as a pivotal player in the global effort to combat climate change. With increasing awareness of the environmental impacts of carbon emissions, governments, businesses, and individuals are turning to carbon credits as a means to reduce their carbon footprint and mitigate climate risks. Carbon credit trading platforms serve as facilitators, connecting buyers and sellers of carbon credits in an efficient and transparent marketplace. This introduction aims to provide an overview of the market, highlighting its significance, key players, and driving forces.

Growth Factors

The growth of the Carbon Credit Trading Platform Market is driven by several key factors. Firstly, stringent regulatory frameworks aimed at reducing greenhouse gas emissions have compelled industries to seek carbon offsetting solutions, thereby boosting demand for carbon credits. Additionally, growing corporate sustainability initiatives and consumer preferences for eco-friendly products have spurred businesses to invest in carbon credits to demonstrate their commitment to environmental responsibility. Moreover, advancements in technology, such as blockchain and AI, are enhancing transparency and efficiency in carbon credit trading, further fueling market growth.

Trends:

Several trends are shaping the Carbon Credit Trading Platform Market. One notable trend is the proliferation of voluntary carbon offsetting programs, driven by corporate commitments to achieve net-zero emissions and meet sustainability targets. Another trend is the increasing popularity of carbon credit certification standards, such as Verified Carbon Standard (VCS) and Gold Standard, which provide credibility and transparency to carbon offset projects. Furthermore, the emergence of innovative financial instruments, such as carbon futures and options, is broadening the scope of carbon trading and attracting new investors to the market.

Carbon Credit Trading Platform Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 17.40% |

| Global Market Size in 2023 | USD 112.4 Million |

| Global Market Size by 2033 | USD 556.7 Million |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By System Type, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

By Type:

- Cap and Trade: This type of carbon credit trading platform sets a limit, or cap, on the total amount of greenhouse gases that can be emitted by covered entities. These entities are then allocated or auctioned permits, or credits, which they can trade among themselves. It encourages emission reductions by creating a financial incentive to reduce emissions below the allocated cap.

- Baseline and Credit: In this type, projects that reduce or remove greenhouse gas emissions below a predetermined baseline are awarded credits. These credits can then be sold to entities seeking to offset their emissions. It incentivizes emission reduction projects and promotes sustainable practices.

By System Type:

- Registry-Based Platforms: These platforms maintain a registry of carbon credits, facilitating the transparent and secure tracking of credits from issuance to retirement. Participants can buy, sell, and retire credits through the registry.

- Exchange-Based Platforms: These platforms operate similarly to financial exchanges, providing a marketplace where buyers and sellers can trade carbon credits. Exchange-based platforms offer greater liquidity and price transparency, but may also introduce additional complexities and risks.

By End-use:

- Corporate: Corporations purchase carbon credits to offset their own emissions and meet sustainability targets. They may also engage in voluntary carbon offsetting initiatives to demonstrate environmental responsibility.

- Government: Governments may participate in carbon credit trading to comply with regulatory requirements, such as emissions reduction targets under international agreements like the Kyoto Protocol or the Paris Agreement.

- Individual/Consumer: Individuals and consumers may purchase carbon credits voluntarily to offset their personal carbon footprint or support carbon reduction projects. This segment is often associated with eco-conscious consumers and organizations promoting carbon neutrality.

Read Also: Automotive Glass Market Size to Growth USD 50.25 Billion by 2033

Recent Developments

- In July 2022, Aircarbon Exchange (ACX) formalized a collaborative agreement with the Nairobi International Financial Center (NIFC) and the Nairobi Securities Exchange (NSE) during the official launch of NIFC. This partnership aims to establish a carbon ecosystem in Kenya that will be seamlessly integrated with ACX’s international client order book. This connectivity will enable both international and domestic buyers and sellers to engage in transparent and efficient carbon transactions.

- In March 2022, CarbonX, a carbon asset developer, entered into a memorandum of understanding (MOU) with AirCarbon Exchange (ACX) to jointly create a carbon marketplace in Indonesia. Through this collaboration, Indonesian carbon project developers will gain access to a domestic carbon market connected to ACX’s international client order book. The envisioned carbon marketplace in Indonesia is expected to contribute to the rapid expansion of the country’s growing carbon market.

- In September 2021, CTX and IBAC joined forces in a partnership geared towards supporting Business Aviation Voluntary Commitments on Climate Change. The International Business Aviation Council (IBAC), representing over 18,000 operators globally, is actively engaged in initiatives aimed at reducing aviation emissions.

Competitive Landscape:

The Carbon Credit Trading Platform Market is characterized by intense competition among various players, including established exchanges, startups, and technology firms. Leading exchanges, such as the Chicago Climate Exchange and European Climate Exchange, dominate the market with their established infrastructure and regulatory compliance. However, innovative startups and technology firms are challenging traditional players by leveraging blockchain and AI technologies to offer decentralized and transparent carbon trading platforms. Additionally, financial institutions and investment firms are entering the market, recognizing the lucrative opportunities in carbon trading and offsetting services. As competition intensifies, players are focusing on enhancing user experience, expanding market reach, and developing new product offerings to gain a competitive edge in the rapidly evolving Carbon Credit Trading Platform Market.

Carbon Credit Trading Platform Market Companies

- AirCarbon Exchange (ACX)

- CarbonX

- CTX (Climate Trade)

- CBL Markets

- Markit (now IHS Markit)

- APX, Inc.

- Climex

- Carbon Trade Exchange (CTX)

- Karbone

- Redshaw Advisors

- EEX Group

- ClearBlue Markets

- ClimateCare

- South Pole

- Bluesource

Segments Covered in the Report

By Type

- Voluntary

- Compliance

By System Type

- Cap and Trade

- Baseline and Credit

By End-use

- Industrial

- Utilities

- Energy

- Petrochemical

- Aviation

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/

- Photodynamic Therapy Market Size to Rake USD 8.42 Bn by 2033 - February 5, 2024

- Image Recognition Market Size to Attain USD 166.01 Bn by 2033 - February 5, 2024

- Hydrogen Storage Tanks and Transportation Market Report 2033 - February 5, 2024