Introduction:

The U.S. Hospital Services Market is a dynamic and critical sector within the healthcare industry, encompassing a wide range of medical services provided by hospitals across the country. With a complex healthcare landscape characterized by evolving patient needs, technological advancements, and regulatory changes, the hospital services market plays a pivotal role in delivering quality healthcare to individuals and communities. Hospitals serve as primary hubs for medical care, offering various services such as emergency care, surgical procedures, diagnostic testing, and specialized treatments for diverse medical conditions. As key players in the healthcare ecosystem, hospitals contribute significantly to disease management, preventive care, and health promotion initiatives, shaping the overall health outcomes of the nation.

Get a Sample: https://www.precedenceresearch.com/sample/3708

Growth Factors:

Several factors contribute to the growth of the U.S. Hospital Services Market. One significant driver is the increasing demand for healthcare services driven by demographic trends, such as an aging population and rising chronic disease prevalence. Technological advancements also fuel market growth by enabling hospitals to enhance diagnostic accuracy, treatment efficacy, and patient outcomes through innovations like telemedicine, robotic surgery, and electronic health records (EHRs). Moreover, expanding health insurance coverage, including government initiatives like Medicare and Medicaid, facilitates greater access to hospital services for a broader segment of the population. Additionally, strategic collaborations between hospitals, healthcare providers, and technology companies facilitate knowledge sharing, resource optimization, and service expansion, fostering market growth and innovation.

U.S. Hospital Services Market Scope

| Report Coverage |

Details |

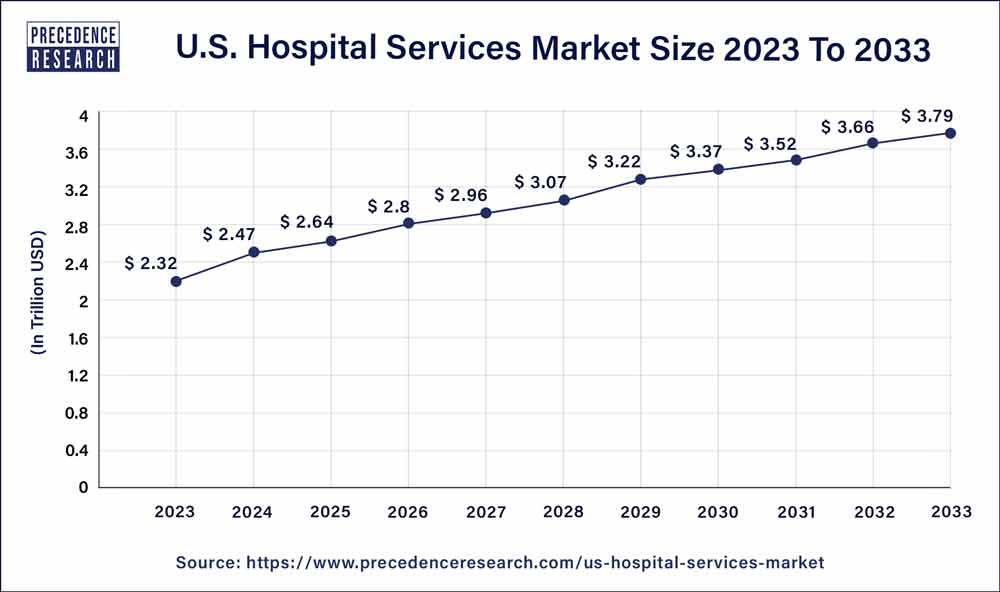

| U.S. Market Size in 2023 |

USD 2.32 Trillion |

| U.S. Market Size by 2033 |

USD 3.79 Trillion |

| Growth Rate from 2024 to 2033 |

CAGR of 4.85% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

By Hospital Type, By Service Type, and By Service Areas |

U.S. Hospital Services Market Dynamics

Drivers:

Several factors propel the growth of the U.S. Hospital Services Market. Firstly, the increasing prevalence of chronic diseases and aging demographics drives the demand for hospital-based healthcare services, including diagnostic procedures, treatment interventions, and ongoing medical management. Additionally, technological advancements, such as digital health solutions, medical robotics, and precision medicine, empower hospitals to deliver more personalized and effective care, thereby attracting patients seeking state-of-the-art treatment options. Furthermore, regulatory changes and healthcare reforms, such as the Affordable Care Act (ACA), incentivize hospitals to prioritize quality improvement, care coordination, and patient satisfaction, driving market expansion. Moreover, strategic partnerships, mergers, and acquisitions within the healthcare industry enable hospitals to streamline operations, optimize resource utilization, and expand service offerings, contributing to market growth and competitiveness.

Restraints:

Despite the promising growth prospects, the U.S. Hospital Services Market faces several challenges and restraints. One significant restraint is the escalating healthcare costs and financial pressures on hospitals due to factors such as reimbursement cuts, rising operational expenses, and uncompensated care for uninsured patients. Additionally, regulatory compliance burdens, including documentation requirements, quality reporting mandates, and accreditation standards, impose administrative burdens on hospitals, diverting resources away from patient care and innovation. Moreover, workforce shortages and talent gaps, particularly in specialized fields like nursing and allied health professions, pose challenges to maintaining adequate staffing levels and delivering high-quality care consistently. Furthermore, market consolidation and monopolistic practices within certain healthcare markets may limit competition, potentially impacting patient choice, service quality, and affordability.

Opportunities:

Despite the challenges, the U.S. Hospital Services Market presents significant opportunities for growth and innovation. Advancements in healthcare technology, such as artificial intelligence, remote monitoring devices, and genomic medicine, offer opportunities for hospitals to enhance patient care, clinical decision-making, and operational efficiency. Moreover, the shift towards value-based care models and population health management creates incentives for hospitals to focus on preventive care, care coordination, and community outreach initiatives, thereby improving health outcomes and reducing healthcare costs. Furthermore, the rise of consumerism in healthcare, driven by empowered patients seeking greater transparency, convenience, and personalized experiences, encourages hospitals to adopt patient-centered approaches, digital health tools, and telehealth services to meet evolving consumer preferences. Additionally, collaborations with non-traditional partners, such as technology companies, retail chains, and community organizations, enable hospitals to diversify revenue streams, expand market reach, and address social determinants of health, unlocking new opportunities for growth and sustainability in the ever-evolving healthcare landscape.

Read Also: Coenzyme Q10 Market Size to Rise USD 1,700.46 Million By 2033

By Hospital Type:

The U.S. Hospital Services Market is diverse, encompassing various types of healthcare facilities that cater to distinct patient needs. General hospitals are the most common, offering a wide range of services, including inpatient and outpatient care, emergency services, and specialized departments. Teaching hospitals, affiliated with medical schools, play a crucial role in medical education and research, often providing advanced and specialized care. Specialty hospitals focus on specific areas such as cardiac, orthopedic, or psychiatric care, tailoring their services to particular medical conditions. Critical access hospitals, located in rural areas, emphasize providing essential services to underserved populations.

By Service Type:

The U.S. Hospital Services Market is multifaceted, offering a spectrum of services to meet the diverse healthcare needs of the population. Inpatient services involve the admission of patients for overnight stays, encompassing medical and surgical care, intensive care, maternity services, and specialty units. Outpatient services provide non-emergency care without the need for overnight hospitalization, including primary care, specialty clinics, diagnostic imaging, and ambulatory surgery. Emergency services address acute medical needs, offering immediate care for various emergencies, from injuries to critical illnesses. Diagnostic and laboratory services play a pivotal role in disease identification and monitoring, encompassing blood tests, imaging, and advanced diagnostic procedures.

By Service Areas:

The U.S. Hospital Services Market extends its reach across geographical and functional service areas. Urban hospitals, situated in metropolitan areas, cater to densely populated communities and often offer a comprehensive range of services. Suburban hospitals serve communities on the outskirts of urban centers, providing a mix of general and specialized care. Rural hospitals, located in less populated regions, focus on ensuring healthcare access to underserved populations. Regional medical centers may serve as hubs for specialized care, drawing patients from surrounding areas. Telemedicine services are increasingly becoming integral, allowing healthcare providers to extend their reach beyond physical locations, providing remote consultations and monitoring for patients in diverse settings.