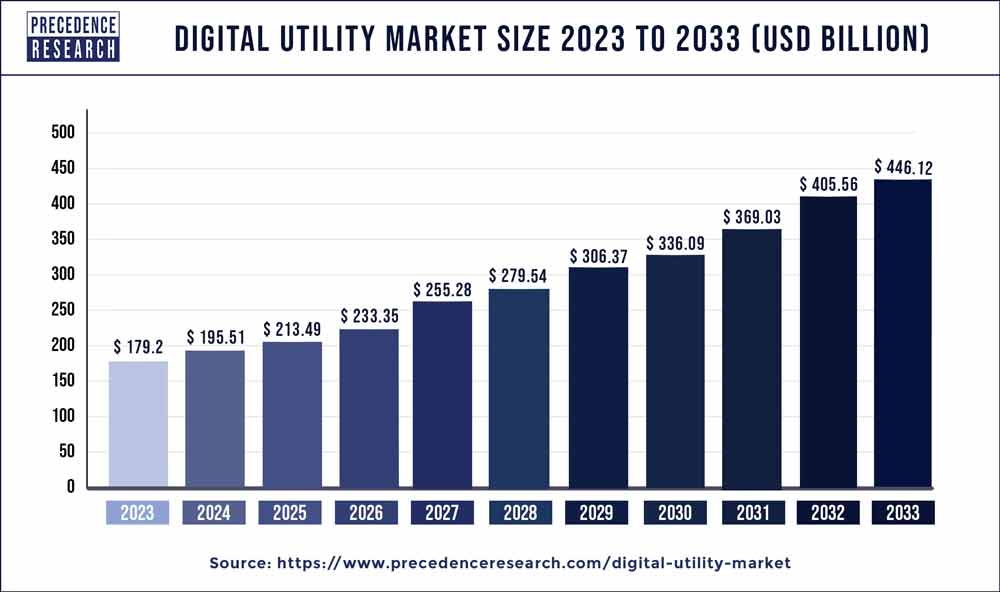

The global digital utility market size reached USD 179.2 billion in 2023 and is projected to grow around USD 446.12 billion by 2033, expanding at a CAGR of 9.60% from 2024 to 2033.

Key Takeaways

- North America contributed more than 31% of market share in 2023.

- Asia-Pacific is estimated to expand the fastest CAGR between 2024 and 2033.

- By network, the transmission & distribution segment has held the largest market share of 47% in 2023.

- By network, the retail segment is anticipated to grow at a remarkable CAGR of 12.9% between 2024 and 2033.

- By technology, the hardware segment generated over 62% of market share in 2023.

- By technology, the integrated solutions segment is expected to expand at the fastest CAGR over the projected period.

The Digital Utility market has emerged as a transformative force in the global energy and utilities sector, reshaping traditional approaches to power generation, distribution, and consumption. Rapid advancements in digital technologies have propelled utilities to embrace innovative solutions, creating a paradigm shift towards enhanced efficiency, sustainability, and customer engagement.

Drivers:

Several key drivers propel the growth of the Digital Utility market. Firstly, the increasing integration of renewable energy sources, such as solar and wind, has necessitated advanced digital solutions for efficient grid management. Secondly, the growing demand for real-time monitoring and control of utility assets, coupled with the need for predictive maintenance, has driven the adoption of digital technologies. Additionally, regulatory mandates promoting smart grids and the rising awareness of environmental sustainability contribute significantly to the expansion of the digital utility landscape.

Region Snapshot

The Digital Utility transformation is a global phenomenon, with various regions experiencing dynamic shifts in their energy landscapes. Developed regions like North America and Europe lead the way, driven by a strong emphasis on technological innovation and environmental consciousness. In emerging economies across Asia-Pacific, the adoption of digital utility solutions is gaining momentum, fueled by increasing urbanization, energy demand, and government initiatives. Each region presents unique challenges and opportunities, shaping the global trajectory of the Digital Utility market.

Recent Developments

- In May of 2023, Siemens, the renowned German manufacturing company, unveiled its latest offering, Industrial Operations X. This innovative portfolio empowers users to effortlessly integrate hardware and software components, enabling operational technology (OT) to adapt swiftly to the pace of software advancements.

- In September 2021, Innowatts, an artificial intelligence firm, joined forces with Amazon Web Services to propel the digital transformation of energy providers. By harnessing the full potential of cloud-based and highly scalable data analytics, Innowatts aims to process over 4 billion data points per hour. This initiative seeks

Get a Sample: https://www.precedenceresearch.com/sample/3684

Digital Utility Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 9.60% |

| Global Market Size in 2023 | USD 179.2 Billion |

| Global Market Size by 2033 | USD 446.12 Billion |

| U.S. Market Size in 2023 | USD 38.89 Billion |

| U.S. Market Size by 2033 | USD 98.59 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Network and By Technology |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

By Network:

The Digital Utility Market, when segmented by network, focuses on the intricate web of interconnected systems that form the backbone of modern utilities. In this context, the network refers to the communication infrastructure that enables seamless data exchange between various components within a utility ecosystem. Smart grids, a pivotal aspect of digital utilities, are a prime example. These grids leverage advanced communication networks to enhance the efficiency and reliability of energy distribution. By integrating sensors, meters, and other devices into a unified network, utilities can monitor, analyze, and manage their infrastructure in real-time, leading to optimized operations and improved overall performance.

By Technology:

When segmented by technology, the Digital Utility Market delves into the tools and solutions driving the transformation of traditional utilities into digital entities. Advanced metering infrastructure (AMI), a key technological component, facilitates the collection and exchange of real-time data between utility providers and consumers. Additionally, the integration of Internet of Things (IoT) devices, artificial intelligence (AI), and machine learning (ML) technologies plays a crucial role in enhancing operational efficiency. AI-powered analytics, for instance, enables utilities to extract valuable insights from vast datasets, empowering them to make informed decisions and anticipate potential issues. The adoption of cloud computing further accelerates digital transformation by providing scalable and cost-effective storage and processing solutions. These technologies collectively contribute to creating agile, responsive, and sustainable digital utility ecosystems.

Read Also: Adaptive AI Market Size Will be USD 24.63 Billion By 2033

Competitive Landscape:

The Digital Utility market is marked by intense competition among key players striving to position themselves as leaders in this evolving ecosystem. Established technology firms, energy conglomerates, and innovative startups are vying for market share by offering comprehensive solutions encompassing smart grid technologies, advanced analytics, and cybersecurity. Strategic partnerships, mergers, and acquisitions are prevalent as companies seek to broaden their product portfolios and enhance their capabilities. As the market matures, the competitive landscape is expected to witness further consolidation, with a focus on delivering seamless, integrated digital solutions to utilities worldwide.

Digital Utility Market Companies

- General Electric

- Siemens AG

- ABB Ltd.

- Schneider Electric SE

- IBM Corporation

- Cisco Systems, Inc.

- Oracle Corporation

- Itron, Inc.

- Honeywell International Inc.

- Eaton Corporation

- Landis+Gyr AG

- Sensus (Xylem Inc.)

- Huawei Technologies Co., Ltd.

- Toshiba Corporation

- Aclara Technologies LLC

Segments Covered in the Report

By Network

- Generation

- Transmission & Distribution

- Retail

By Technology

- Hardware

- Integrated Solutions

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/

- Photodynamic Therapy Market Size to Rake USD 8.42 Bn by 2033 - February 5, 2024

- Image Recognition Market Size to Attain USD 166.01 Bn by 2033 - February 5, 2024

- Hydrogen Storage Tanks and Transportation Market Report 2033 - February 5, 2024