Key Takeaways

- Asia Pacific contributed more than 49.28% of the market share in 2023.

- North America is estimated to expand the fastest CAGR between 2024 and 2033.

- By form, the bricks & shaped segment has held the largest market share of 55% in 2023.

- By form, the monolithic & unshaped segment is anticipated to grow at a remarkable CAGR of 5.8% between 2024 and 2033.

- By product, the clay segment generated over 66% of the market share in 2023.

- By product, the non-clay segment is expected to expand at the fastest CAGR over the projected period.

- By alkalinity, the basic segment generated over 59% of the market share in 2023.

- By alkalinity, the acidic & neutral segment is expected to expand at the fastest CAGR over the projected period.

- By end-use industry, the iron & steel segment generated over 36% of market share in 2023.

- By end-use industry, the cement segment is expected to expand at the fastest CAGR over the projected period.

The Refractories Market is a vital sector within the broader materials industry, primarily dealing with materials resistant to extreme heat and wear. These specialized materials find extensive application in high-temperature industrial processes, such as metal smelting, glass manufacturing, and cement production. Refractories play a crucial role in enabling these processes by providing stability and durability to materials exposed to intense heat, making them an indispensable component in various manufacturing sectors.

Growth Factors

The growth of the Refractories Market is propelled by several key factors. First and foremost, the expanding industrial activities worldwide, particularly in emerging economies, drive the demand for refractory materials. Additionally, advancements in manufacturing processes and technologies necessitate more robust and heat-resistant materials, further boosting the market. The rise in infrastructure projects, coupled with the surge in demand for high-performance refractories from the iron and steel industry, contributes significantly to the market’s growth.

Get a Sample: https://www.precedenceresearch.com/sample/3680

Trends:

In recent years, the Refractories Market has witnessed notable trends shaping its landscape. One prominent trend is the increasing focus on developing eco-friendly refractory materials to align with sustainable practices. Another significant trend involves the integration of smart technologies into refractory products, enhancing their performance and longevity. Additionally, there is a growing trend towards customization, with manufacturers catering to specific industry requirements, thereby offering tailor-made refractory solutions.

Region:

The Refractories Market exhibits regional variations based on industrial activities and economic development. Developing regions, such as Asia-Pacific, witness robust growth due to expanding manufacturing sectors. North America and Europe, with established industrial bases, contribute significantly to the market, driven by ongoing technological advancements and infrastructure projects. The Middle East and Africa also play a role, particularly with the increasing focus on oil and gas exploration and refining activities.

Refractories Market Scope

| Report Coverage | Details |

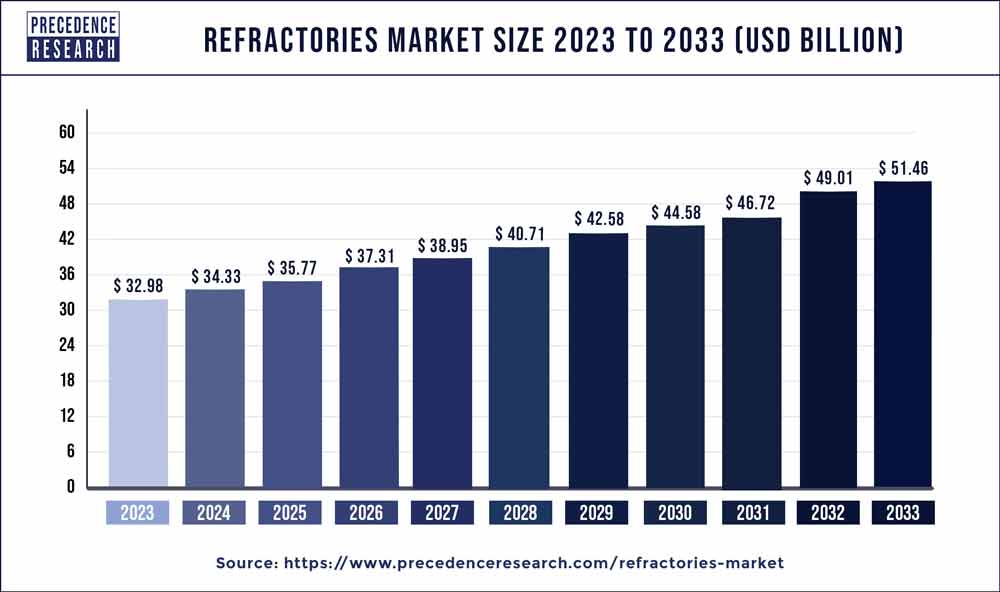

| Global Market Size in 2023 | USD 32.98 Billion |

| Global Market Size by 2033 | USD 51.46 Billion |

| Asia-Pacific Market Size in 2023 | USD 16.25 Billion |

| Asia-Pacific Market Size by 2033 | USD 25.85 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Form, By Product, By Alkalinity, and By End-Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

By Form:

The refractories market can be categorized by form, with two primary classifications: shaped and unshaped refractories. Shaped refractories are pre-formed materials, such as bricks, tiles, and special shapes, tailored for specific applications like furnace linings. On the other hand, unshaped refractories, also known as monolithic refractories, come in a single, cohesive form, including castables, gunning mixes, and ramming mixes. This distinction allows industries to choose materials based on their preferences for ease of installation, adaptability, and specific application requirements.

By Product:

Within the refractories market, products are further differentiated based on their composition and characteristics. Traditional refractory products include bricks, which are commonly used in furnaces and kilns due to their strength and durability. Refractory castables, another product category, offer versatility in application and are widely used in various industries. Other products such as plastic refractories, refractory mortars, and specialty refractories cater to specific needs, providing a diverse range of solutions for different industrial processes.

By Alkalinity:

Alkalinity is a crucial factor in classifying refractories based on their chemical composition. Acidic refractories, resistant to acidic environments, are commonly used in industries like fertilizer production. Basic refractories, on the other hand, are designed to withstand basic or alkaline conditions and find applications in industries such as steel manufacturing. The classification based on alkalinity ensures that industries can select refractories that align with the specific chemical conditions prevalent in their processes.

By End-Use:

The refractories market is segmented by end-use industries, reflecting the diverse applications of these materials. Industries such as steel, cement, and glass manufacturing heavily rely on refractories for constructing furnaces, kilns, and other high-temperature equipment. The petrochemical industry utilizes refractories for lining reactors and vessels, while power generation relies on these materials for boilers and incinerators. The segmentation by end-use ensures that refractory solutions are tailored to the unique demands and challenges posed by each industry, emphasizing the importance of customized refractory materials in different applications.

Read Also: Sequencing Consumables Market Size Will be USD 50.75 Bn By 2033

Recent Developments in the Refractories Market

- In June 2023, INTOCAST AG revealed its plan to acquire EXUS Refractories S.p.A, an Italian company, as part of its strategy to enhance its production facility with modern technological advancements. The acquisition is expected to fortify INTOCAST AG’s refractory product portfolio, positioning it for sustained growth.

- In April 2023, RHI Magnesita announced its acquisition of the U.S., India, and Europe operations of seven refractories, non-basic monolithic specialists. With a recorded revenue of USD 110 million and PBT of USD 12 million in 2022, this strategic move aims to bring innovative product categories and technological advancements, providing a significant leap in consumer offerings on the global market.

- In October 2021, Intocast expanded its presence in the Americas by acquiring Pyrol, a Mexican manufacturer and trader of refractory products and casting auxiliaries.

- In September 2021, Plibrico Company, LLC completed the acquisition of Redline Industries, Inc., a pioneer in product innovation for high-temperature furnace protection, with a focus on promoting energy efficiency. This acquisition enhances Plibrico’s position in the competitive market, offering customers trusted refractory solutions and expanding its product portfolio.

Competitive Landscape:

The Refractories Market boasts a competitive landscape characterized by the presence of key players vying for market share. Established companies often focus on research and development to introduce innovative and high-performance refractory products. Mergers and acquisitions are common strategies employed by industry players to strengthen their market position. Additionally, collaborations with end-user industries and a strong global distribution network are crucial aspects of maintaining a competitive edge in this dynamic market. The market’s competitive nature fosters continuous innovation and drives companies to adapt to evolving industry demands.

Refractories Market Companies

- INTOCAST AG

- RHI Magnesita

- Plibrico Company, LLC

- EXUS Refractories S.p.A

- Pyrol

- Redline Industries, Inc.

- Saint-Gobain

- HarbisonWalker International

- Vesuvius plc

- Morgan Advanced Materials

- Shinagawa Refractories Co., Ltd.

- Resco Products, Inc.

- Calderys

- Krosaki Harima Corporation

- Imerys Group

Segments covered in the report

By Form

- Bricks & Shaped

- Monolithic & Unshaped

By Product

- Clay

- Non-Clay

- By Alkalinity:

- Acidic & Neutral

- Basic

By End-Use Industry

- Iron & Steel

- Non-Ferrous Metals

- Glass

- Cement

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

- Photodynamic Therapy Market Size to Rake USD 8.42 Bn by 2033 - February 5, 2024

- Image Recognition Market Size to Attain USD 166.01 Bn by 2033 - February 5, 2024

- Hydrogen Storage Tanks and Transportation Market Report 2033 - February 5, 2024