Key Takeaways

- North America contributed more than 42% of market share in 2022.

- Asia-Pacific is estimated to expand the fastest CAGR between 2023 and 2032.

- By lift technology, the vectored thrust segment has held the largest market share of 40% in 2022.

- By lift technology, the multirotor segment is anticipated to grow at a remarkable CAGR of 51.4% between 2023 and 2032.

- By maximum take-off weight, the <250 kg segment generated over 28% of market share in 2022.

- By maximum take-off weight, the 250-500 kg segment is expected to expand at the fastest CAGR over the projected period.

- By range, the 0-200 Km segment generated over 56% of market share in 2022.

- By range, the 250-500 Km segment is expected to expand at the fastest CAGR over the projected period.

The eCTOL (electric conventional takeoff and landing) aircraft market is witnessing significant growth as the aviation industry undergoes a transformative shift towards sustainable and electric aviation solutions. eCTOL aircraft, characterized by their reliance on electric propulsion for conventional takeoff and landing operations, represent a pivotal advancement in the sector. The demand for eco-friendly aviation alternatives, coupled with advancements in electric propulsion technologies, is propelling the eCTOL aircraft market into a prominent position within the broader aviation landscape.

Growth Factors:

Several key factors contribute to the growth of the eCTOL aircraft market. The increasing emphasis on reducing carbon emissions in the aviation sector, stringent environmental regulations, and the growing awareness of sustainable travel are driving the adoption of electric aircraft. Moreover, advancements in battery technology, offering improved energy density and longer operational ranges, play a crucial role in boosting the feasibility and appeal of eCTOL aircraft. As governments and aviation stakeholders increasingly invest in sustainable aviation solutions, the eCTOL market is poised for sustained growth.

Get a Sample: https://www.precedenceresearch.com/sample/3656

Drivers:

The drivers behind the eCTOL aircraft market’s expansion are multifaceted. The primary driver is the global aviation industry’s commitment to mitigating its environmental impact. Electric aircraft, with their lower carbon footprint compared to traditional counterparts, align with the industry’s goals of achieving sustainability. Additionally, rising fuel costs and the need for operational cost efficiencies are driving airlines and operators to explore electric propulsion solutions. The potential for reduced operating costs and increased energy efficiency serves as a compelling driver for the adoption of eCTOL aircraft.

Trends:

In the eCTOL aircraft market, notable trends include continuous innovations in battery technology, the development of more efficient electric propulsion systems, and the integration of advanced materials for enhanced aerodynamics. Urban air mobility initiatives are also contributing to the rise of eCTOL aircraft, with a focus on creating efficient, point-to-point transportation solutions within urban environments. Furthermore, collaborations between aerospace companies and technology firms are shaping trends by fostering synergies in expertise and resources to accelerate the development and deployment of eCTOL aircraft.

Competitive Landscape:

The competitive landscape of the eCTOL aircraft market is characterized by a mix of established aerospace players and innovative startups. Major aerospace companies are investing heavily in research and development to bring advanced eCTOL aircraft models to market. Simultaneously, startups are leveraging agility and innovation to introduce novel designs and technologies. Collaboration and partnerships between traditional aviation giants and emerging players are becoming increasingly common, as the industry seeks to leverage collective expertise and resources to address the complex challenges associated with electric aviation. As the market matures, competition is intensifying, driving further advancements and pushing the boundaries of electric aircraft technology.

eCTOL Aircraft Market Scope

| Report Coverage | Details |

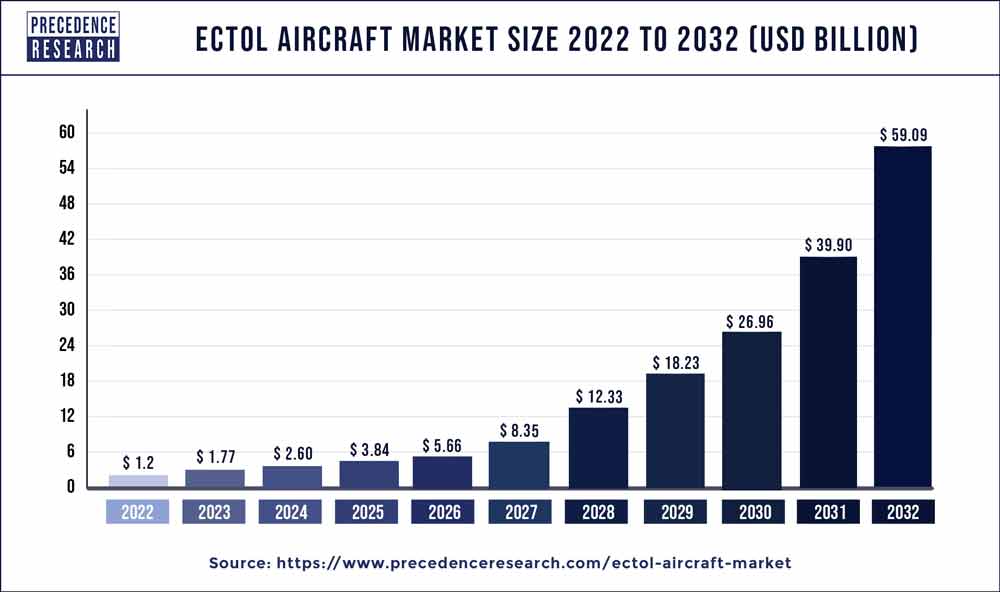

| Growth Rate from 2023 to 2032 | CAGR of 47.50% |

| Market Size in 2023 | USD 1.77 Billion |

| Market Size by 2032 | USD 59.09 Billion |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Lift Technology, By Maximum Take-off Weight (MTOW), and By Range |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Lift Technology:

- Vectored Thrust

- Multirotor

- Lift Plus Cruise

The eCTOL Aircraft Market encompasses various lift technologies, each playing a crucial role in the performance and capabilities of electric conventional takeoff and landing aircraft. These technologies include but are not limited to vertical takeoff and landing (VTOL), short takeoff and landing (STOL), and conventional takeoff and landing (CTOL). VTOL eCTOL aircraft, in particular, are gaining prominence for their versatility and ability to operate in confined spaces, opening up new possibilities for urban air mobility and other applications.

Maximum Take-off Weight (MTOW):

- <250 Kg

- 250-500 Kg

- 500-1500 Kg

- >1500 Kg

The segmentation of the eCTOL Aircraft Market by Maximum Take-off Weight (MTOW) categorizes aircraft based on their weight-carrying capacity. This classification is vital for determining the range, payload capacity, and overall mission capabilities of eCTOL aircraft. Different weight classes cater to various market needs, ranging from lightweight urban air mobility solutions to heavier eCTOL aircraft suitable for regional transportation and cargo applications.

Range:

- 0-200 Km

- 200-500 Km

The range of eCTOL aircraft is a critical factor influencing their applicability for specific use cases. The market features a spectrum of ranges tailored to different mission requirements. Short-range eCTOL aircraft are suitable for urban commuting and regional travel, while long-range variants extend their applications to inter-city and potentially intercontinental travel. The continuous advancement of battery and propulsion technologies contributes to the expansion of eCTOL aircraft range capabilities, addressing the evolving needs of the market.

Recent Developments

- In December 2022, Lilium GmbH and JOBY Aviation entered a definitive business combination agreement. The resulting merged entity is expected to possess a pro forma enterprise value of approximately $10.5 billion. This strategic move involves combining the strengths of both Lilium and JOBY Aviation, positioning the joint company as a major player in the urban air mobility (UAM) sector.

- In December 2022, Eve Holding, Inc., a subsidiary of Embraer S.A. dedicated to urban air mobility solutions, announced a definitive business combination agreement with Zanite Acquisition Corp. This collaboration signifies a strategic alignment between Eve and Zanite, a special purpose acquisition company (SPAC). The agreement reflects the ongoing trend of SPAC mergers within the electric aviation industry, providing capital and market access for companies focused on developing and deploying urban air mobility solutions.

eCTOL Aircraft Market Companies

- Joby Aviation

- Vertical Aerospace

- Lilium GmbH

- Eve Urban Air Mobility

- Pipistrel

- AeroMobil

- Beta Technologies

- Kitty Hawk

- Archer Aviation

- Ampaire

- Urban Aeronautics

- Volocopter

- EmbraerX

- Zunum Aero

- Wisk Aero

Segments Covered in the Report

By Lift Technology

- Vectored Thrust

- Multirotor

- Lift Plus Cruise

By Maximum Take-off Weight (MTOW)

- <250 Kg

- 250-500 Kg

- 500-1500 Kg

- >1500 Kg

By Range

- 0-200 Km

- 200-500 Km

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

- Photodynamic Therapy Market Size to Rake USD 8.42 Bn by 2033 - February 5, 2024

- Image Recognition Market Size to Attain USD 166.01 Bn by 2033 - February 5, 2024

- Hydrogen Storage Tanks and Transportation Market Report 2033 - February 5, 2024