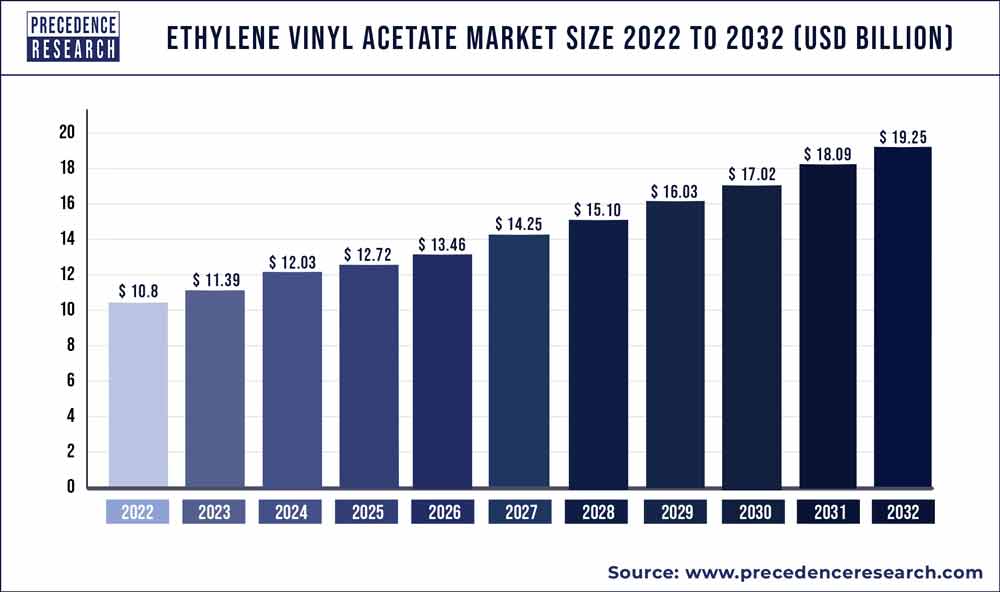

The global ethylene vinyl acetate market size reached USD 11.39 billion in 2023 and is projected to grow around USD 19.25 billion by 2032, at a CAGR of 6% from 2023 to 2032.

Key Takeaways

- Asia Pacific contributed more than 43% of revenue share in 2022.

- North America is estimated to expand the fastest CAGR between 2023 and 2032.

- By grade, the medium density segment has held the largest market share of 41% in 2022.

- By grade, the high-density segment is anticipated to grow at a remarkable CAGR of 7.2% between 2023 and 2032.

- By application, the adhesives segment generated over 35% of revenue share in 2022.

- By application, the films segment is expected to expand at the fastest CAGR over the projected period.

The Ethylene Vinyl Acetate (EVA) market is experiencing substantial growth driven by a myriad of factors. Firstly, the increasing demand for flexible packaging materials across various industries has significantly contributed to the expansion of the EVA market. This polymer, known for its excellent flexibility and durability, has found widespread applications in packaging solutions, ranging from food packaging to industrial packaging.

Growth Factors:

One of the key growth factors propelling the EVA market is its versatility. EVA is not only a cost-effective material but also offers outstanding impact resistance, making it an ideal choice for industries requiring durable yet lightweight products. Moreover, the rising awareness of sustainable and eco-friendly materials has further boosted the adoption of EVA, given its recyclability and low environmental impact.

Get a Sample: https://www.precedenceresearch.com/sample/3561

Market Dynamics:

The dynamics of the Ethylene Vinyl Acetate market are shaped by the continuous innovations and developments within the polymer industry. Manufacturers are focusing on enhancing the properties of EVA to meet evolving industry requirements. Additionally, collaborations and partnerships among key players in the value chain are fostering innovation and ensuring a steady supply chain.

The market dynamics are also influenced by the regulatory landscape, with stringent environmental regulations promoting the use of materials with lower carbon footprints. As EVA aligns with these sustainability goals, it stands poised to capitalize on the evolving regulatory environment.

Regional Impact:

The growth and dynamics of the EVA market vary across regions. Asia-Pacific, with its burgeoning industrial sectors, remains a dominant player in the market. The region’s robust manufacturing activities and increasing consumer demand contribute significantly to the demand for EVA in packaging, construction, and automotive applications.

North America and Europe, while experiencing steady growth, are characterized by a focus on sustainable practices. This has led to increased adoption of EVA in these regions, aligning with the global shift towards eco-friendly solutions.

Ethylene Vinyl Acetate Market Scope

| Report Coverage | Details |

| Growth Rate from 2023 to 2032 | CAGR of 6% |

| Market Size in 2023 | USD 11.39 Billion |

| Market Size by 2032 | USD 19.25 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Grade and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Opportunities and Challenges

The Ethylene Vinyl Acetate (EVA) market presents a landscape filled with promising opportunities and intricate challenges. On the bright side, EVA, a copolymer of ethylene and vinyl acetate, boasts a versatile range of applications across industries. Its flexibility, durability, and low-temperature properties make it a sought-after material in the production of various products, including foams, films, adhesives, and footwear.

One significant opportunity lies in the expanding demand for eco-friendly and sustainable materials. EVA, being recyclable and having a lower environmental impact compared to some alternatives, positions itself favorably in the wake of growing environmental consciousness. This green trend opens avenues for market growth as industries increasingly adopt EVA as a responsible choice in their manufacturing processes.

However, navigating the Ethylene Vinyl Acetate market isn’t without its set of challenges. Fluctuating raw material costs, particularly those of ethylene and vinyl acetate monomers, pose a constant challenge for manufacturers. Market players must adeptly manage these cost dynamics to maintain competitiveness and ensure profitability amid market uncertainties.

Moreover, the competitive landscape is intense, with numerous players vying for market share. Product differentiation and innovation become crucial in standing out among competitors. Striking the right balance between product quality, cost-effectiveness, and innovation becomes paramount for companies looking to thrive in this dynamic market.

Recent Developments

- In June 2023, PetroChina Guangxi Petrochemical Company revealed its adoption of LyondellBasell’s polyethylene technology at its Qinzhou City facility in Guangxi, China. The utilization of LyondellBasell’s Lupotech process technology is geared toward the production of primarily low-density polyethylene (LDPE) with ethylene vinyl acetate copolymers (EVA).

- In February 2023, Celanese Corporation successfully concluded an ultra-low capital project aimed at repurposing existing manufacturing and infrastructure assets at its Edmonton, Alberta facility. This strategic initiative led to a noteworthy 35% increase in the facility’s ethylene vinyl acetate (EVA) capacity, showcasing Celanese’s commitment to expanding and optimizing its EVA production capabilities. These developments underscore the dynamic nature of the ethylene vinyl acetate market, with key players making strategic moves to enhance their production capacities and technological capabilities.

Ethylene Vinyl Acetate Market Players

- DuPont

- ExxonMobil Corporation

- Hanwha Total Petrochemical Co., Ltd.

- LyondellBasell Industries N.V.

- Arkema SA

- Braskem S.A.

- Celanese Corporation

- Sumitomo Chemical Co., Ltd.

- Formosa Plastics Corporation

- Sinopec Corporation

- Tosoh Corporation

- Saudi Basic Industries Corporation (SABIC)

- LG Chem Ltd.

- Westlake Chemical Corporation

- Repsol S.A.

Segments Covered in the Report

By Grade

- Low Density

- Medium Density

- High Density

By Application

- Films

- Adhesives

- Foams

- Solar Cell Encapsulation

- Other Applications

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

- Photodynamic Therapy Market Size to Rake USD 8.42 Bn by 2033 - February 5, 2024

- Image Recognition Market Size to Attain USD 166.01 Bn by 2033 - February 5, 2024

- Hydrogen Storage Tanks and Transportation Market Report 2033 - February 5, 2024