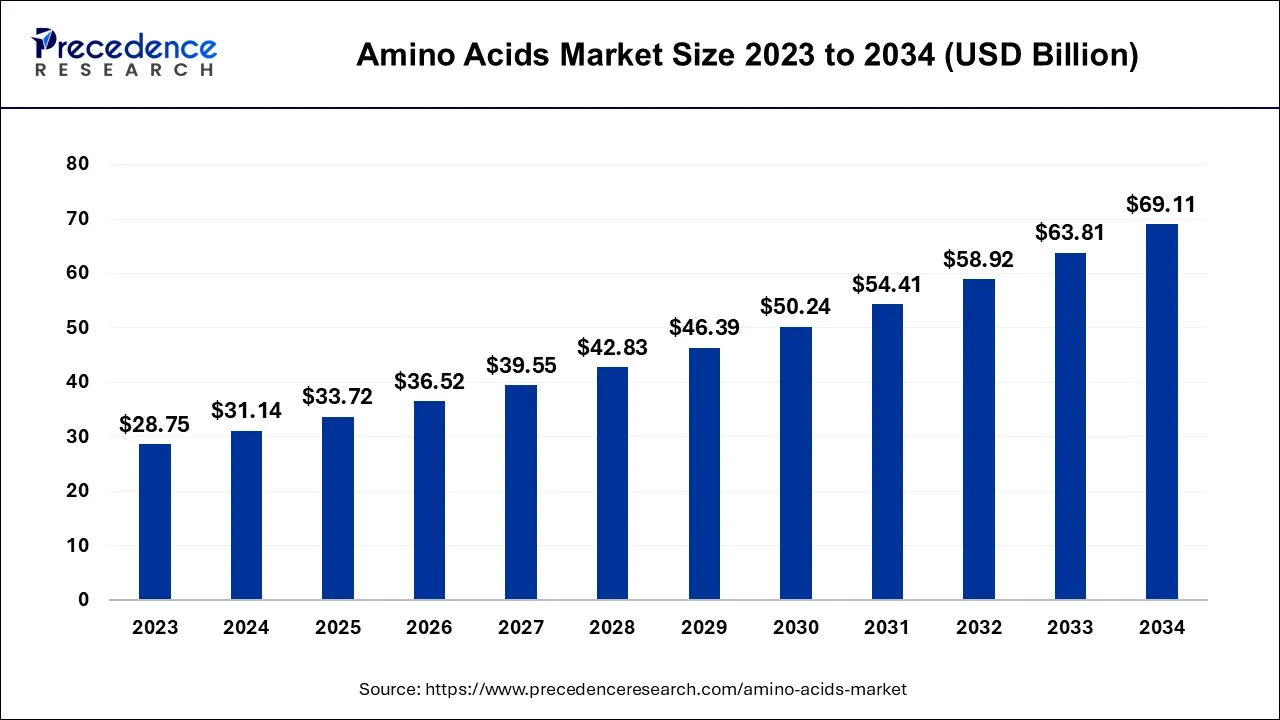

The global amino acids market size was estimated at USD 28.75 billion in 2023 and is projected to Surpassed USD 69.11 billion by 2034, growing at a CAGR of 8.3% from 2024 to 2034.

The rising awareness among consumers about leading a healthy life and increasing consumption of meat-based products are projected to boost the demand for amino acids. Moreover, the demand for high-protein foods and nutritional supplements is rising among fitness enthusiasts, athletes, and health-conscious consumers, which contributes to the market expansion.

Key Insights

- Asia Pacific amino acids market has captured revenue share of 49% in 2023.

- Based on raw material, the plant-based segment has accounted revenue share of 86.50% in 2023.

- Based on product, L-glutamate segment has accounted revenue share of 49.70% in 2023.

- Based on livestock, the poultry industry has generated revenue share of 44% in 2023.

- By application, the food and dietary supplements segment has garnered revenue share of 57% in 2023.

In 2023 Asia Pacific has dominated the amino acids market

Asia Pacific dominated the amino acids market in 2023. This is mainly due to the improved living styles and the high demand for nutritional and beauty products. Amino acids play a key role in muscle degeneration and treat liver and heart disease conditions. Due to this, they are in high demand among the health-conscious population in the region. Moreover, China is the largest producer of amino acids in the world, accounting for 68% of the production of essential amino acids, thus contributing to the market growth in the region.

India Amino Acids Market

In India, amino acids are utilized in the production of nutritional supplements for the pharmaceutical industry and various beauty products. Plant-based amino acids are particularly favored due to religious beliefs. These amino acids are primarily used in nutraceuticals, offered as dietary supplements to enhance immune function and provide alternative treatments for certain health conditions. Growing consumer awareness about health, coupled with issues like imbalanced diets, workplace stress, and the influence of foreign lifestyles, has spurred demand for dietary supplements in the region, which is expected to further drive market growth.

China Amino Acids Market

Increasing pork consumption in China is anticipated to boost market growth in the country. Heightened health concerns and rising personal medical expenses are likely to drive demand for dietary supplements, which will subsequently increase the demand for these products. Additionally, the growing trend toward ready-to-drink (RTD) beverages is expected to positively impact the demand for aspartame, leading to higher consumption of aspartic acids in the region throughout the forecast period.

| Report Coverage | Details | |

| Amino Acids Market Size in 2024 | $28.75 | |

| Amino Acids Market Size by 2033 | $69.11 | |

| Amino Acids Market CAGR | 8.3% from 2024 to 2034 | |

| Amino Acids Market Segmentation | Raw Material, Product, Application, Livestock, Form, Function, Purity Level, and Regions | |

| Amino Acids Market Companies | 3D Systems Corporation (US), Stratasys, Ltd. (US), Materialise NV (Belgium), Arkema SA (France), Evonik Industries AG (Germany), General Electric (US), The ExOne Company (US), Hoganas AB (Sweden), Royal DSM N.V. (Netherlands) | |

Europe is growing faster in amino acid market

Europe ranks as the second-largest producer of compound feed in the world, with Germany and France leading in production. Poultry feed constitutes a significant portion of the region’s compound feed market, making up around one-third of the total. Major companies in this market have diversified operations and extensive product ranges for animal feed. The anticipated increase in the production and consumption of animal feed is expected to fuel market growth in the region during the forecast period.

Amino Acid Market Revenue Share, By Region, 2023

| Region | Share (%) |

| North America | 23 |

| Asia Pacific | 49 |

| Europe | 20 |

| LAMEA | 8 |

Raw material Insights

The plant-based segment led the market with the largest share in 2023 due to a significant increase in the consumption of plant-based products. Wheat, maize, soybeans, and peas contain essential amino acids. Starchy vegetables such as corn, potatoes, and taro also provide all nine essential amino acids.

Application of plant-derived amino acids includes glucosinolate production, stress defense mechanisms, human health influences, nutraceuticals, and plant growth enhancement. Plant proteins, such as arginine, support collagen formation, while glutamine generates nitric oxide and creatine, which are necessary for proper immune function.

For instance, proline, a non-proteinogenic amino acid, plays an important role in managing stress and being involved in glucosinolate synthesis, which has antioxidant and anticancer properties. Moreover, plant-based amino acids are devoid of antibiotics, allergens, and hormones, making them a healthier and safer alternative to animal-based proteins.

- In July 2024, Herbochem introduced a new line of plant-based proteins for improved fitness, catering to the growing demand for sustainable, high-quality protein sources for an active lifestyle.

Product Insights

The L-Glutamate segment held the largest share of the market in 2023. Monosodium glutamate (MSG), the sodium salt of L-Glutamate, popularly known as seasoning salt, is widely used as a flavor enhancer in food and beverages. This naturally occurring amino acid stimulates glutathione synthesis and is an energy source for certain tissues. Additionally, it can evoke visceral sensations from the stomach, intestine, and portal vein. It also has the potential to increase appetite among older individuals. It can be used with table salt to decrease the total amount of table salt during food preparations and post-consumption.

Livestock Insights

The poultry segment dominated the amino acids market in 2023. A chicken’s body needs proteins for healthy production, immunity fortification, digestion maintenance, stress response, wound healing, and antioxidant and serotonin synthesis. Also, synthesizing serotonin, proteins, immune response, digesting process, wound healing, and the production of versatile antioxidants rely on these amino acids.

Arginine is one of several important poultry amino acids, such as glutamine, methionine, and threonine. These hormones play an important role during immune reactions inside a chicken’s body; they also promote a healthy digestive tract, protein synthesis, and optimal growth. They are also responsible for stomach development (growing), antioxidant production, and wound healing.

Application Insights

The food and dietary supplements segment led the market with the largest share in 2023. In the food industry, processing necessary amino acids are meant for nutrition boosters and flavor enhancers. Alanine and glycine are among the frequently used amino acids that improve taste. However, amino acids are vital for protein synthesis, muscle development and recovery, blood glucose regulation, regulating moods, better sleep, and generating energy. Besides this, they are used in food and beverages to increase the nutrient composition of finished products.

Market Dynamics

Driver

Rising awareness among people about the benefits of amino acid

Food and beverage companies focus on developing products with essential nutrients, including amino acids, due to increased awareness about the need for nutrient-rich diets. This leads to a higher demand for protein-rich diets among fitness enthusiasts and athletes. Furthermore, energy drinks and sports drinks are gaining immense popularity. There is also a rising requirement for animal and plant-based products. Moreover, proteins’ requirement levels in animal feeds are satisfied by providing amino acids. Thus, the rising demand for animal feed further contributes to the expansion of the amino acid market.

Restraint

High cost hampering the growth of the market

The worldwide amino acid industry is facing challenges due to a rise in logistics and raw materials costs. Amino acids are derived from wheat, soybean oilseeds, and corn. However, fluctuations in the price of these raw materials significantly impact production costs. There is also a heightened demand for grains and oilseeds, which worsens the deficit and inhibits market growth.

Opportunity

Advanced methods for reducing production cost

Advancements in the production process of amino acids have made the production of amino acids easier and more efficient. Microbial fermentation accounts for 80% of global amino acid production. High-performance methods are necessary to yield large quantity of amino acids. New screening approaches like auxotrophic-based, biosensor-based, and translation-based methods have been developed after screening mutants.

The design concepts of these methods, as well as their application scope, efficiency, accuracy, and universality, have been examined. It has also been studied whether it is possible to screen non-standard amino acids. Novel technologies provide opportunities to enhance screening tactics in the future to accelerate the rebuilding of overproduced amino acids, opening up new doors of market expansion.

Recent developments

- In August 2024, Celsius Holdings, Inc., a leading manufacturer of fitness drinks, expanded its product line with an innovative BCAA (branched-chain amino acids) functional beverage for muscle recovery.

- In February 2024, Califia Farms introduced Califia Farms Complete, a nutritionally enhanced plant-based milk with all 9 essential amino acids, containing 50% less sugar than dairy milk.

Amino Acids Market Companies

- 3D Systems Corporation (US)

- Evonik Industries AG (Germany)

- Royal DSM N.V. (Netherlands)

- General Electric (US)

- The ExOne Company (US)

- Stratasys, Ltd. (US)

- Materialise NV (Belgium)

- Arkema SA (France)

- Hoganas AB (Sweden)

Segments Covered in the Report

By Raw Material

- Plant Based

- Animal Based

By Product

- L-Glutamate

- Lysine

- Methionine

- Threonine

- Tryptophan

- Leucine

- Iso-Leucine

- Valine

- Glutamine

- Arginine

- Glycine

- Phenylalanine

- Tyrosine

- Citrulline

- Creatine

- Proline

- Serine

- Others

By Application

- Animal Feed

- Food & Dietary Supplements

- Pharmaceutical

By Livestock

- Swine

- Poultry

- Cattle

- Others

By Form

- Powder

- Granules

- Liquid

- Pellet

- Others

By Function

- Fortification

- Energy Booster

- Flavour Enhancer

- Preservative

- Muscle Growth

- Immunity Booster

- Others

By Purity Level

- Amino Acid 99%

- Amino Acid More Than 99%

- Amino Acid 90%

- Amino Acid 80%

- Amino Acid 70%

- Amino Acid Less Than 60%

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Request here to Buy This Premium Report@ https://www.precedenceresearch.com/checkout/2201

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

- Assisted Living Market Size to Attain USD 8.60 Bn by 2034 - April 4, 2025

- Steam Education Market Size to Attain USD 52.74 Bn by 2034 - April 4, 2025

- Marine Sensors Market Size to Attain USD 59.45 Bn by 2034 - April 4, 2025