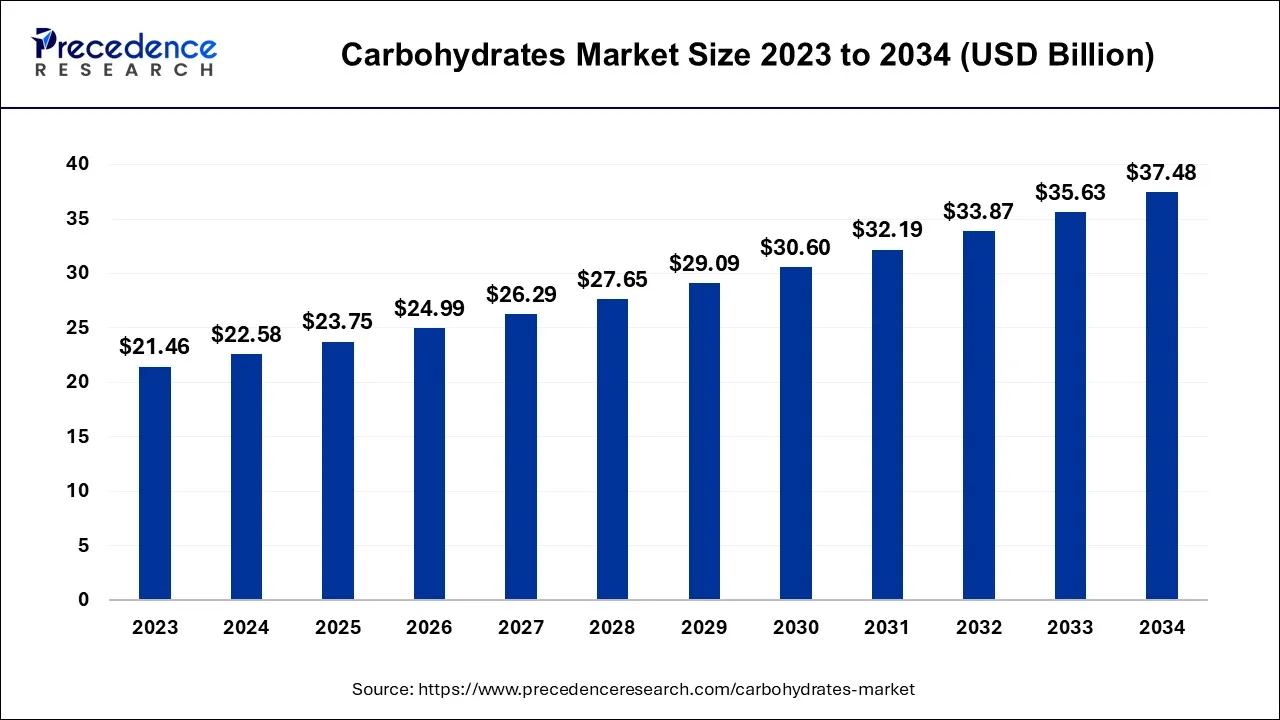

The global carbohydrates market size is expected to hit around USD 37.48 billion by 2034 and is expanding at a CAGR of 5.2% between 2024 and 2034.

Fiber is an essential carbohydrate that helps in digestion and controls blood cholesterol levels. The ability to adapt to changing consumer preferences provides companies with opportunities to produce carbohydrates that meet the varying demands of consumers. In addition, plant-based diets, which are gaining popularity around the globe, and a need for environmentally friendly sourcing and manufacturing processes of carbohydrate-rich products are also driving the market.

Key Insights

- Europe has generated highest revenue share of 38% in the carbohydrates market in 2023.

- North America is poised to grow at a fastest CAGR from 2024 and 2034.

- By Type, the Isomalt segment has captured revenue share of around 34% in 2023.

- The other type segment is growing at a CAGR of 6.5% between 2024 and 2034.

- By Application, the food & beverages segment has accounted highest revenue share of 31% in 2023.

- The other application segment is expected to expand at the fastest CAGR over the projected period.

Europe dominated the global market in 2023

- Europe dominated the global market in 2023 due to its strong focus on sustainable and healthy eating, which boosts the demand for carbohydrate-rich foods. The presence of a well-established food processing and production sector in the region and a strong agricultural base, producing carbohydrates-rich foods such as barley and wheat, further contributed to the regional market growth.

- Moreover, the growing concerns about health and wellness among European population are boosting the demand for vegetarian food options. The UK has the highest vegan population in the world. Additionally, the demand for foods derived from plants, such as plant proteins, carbohydrates, sweeteners, seasonings, herbs, non-alcoholic drinks, and food coloring, is rising, thus boosting the market in Europe.

North America is growing at the fastest rate

- The market in North America is expected to grow at the fastest rate during the forecast period due to the rising health-conscious population in the region. Innovative approaches by food and beverage manufacturers, high disposable incomes, and busy lifestyles have boosted the adoption of sugar-substitute foods. Health-conscious consumers in the region are looking for alternatives to sugar, owing to the increasing awareness about health and wellness. However, carbohydrates are essential macronutrients that are found in food and beverages.

- Moreover, the rapid expansion of the biofuel sector contributes to regional market growth, as carbohydrates are used in ethanol production. The rising inclusion of carbohydrates in regular diet also propels the market in North America.

- The demand for drivers is changing perceptions concerning the naturalness of food ingredients by consumers and their health benefits. It is expected that demand for functional carbohydrates will rise in food products due to a growing preference for natural ingredients especially among people allergic to synthetic substances or having other health problems.

Type Insights

The Isomalt segment dominated the market in 2023. Isomalt has many advantages over sugar. This carbohydrate consists of glucose, mannitol, and sorbitol. It is completely sugar-free. Thus, it is widely used as a sugar substitute in food & beverages and sugar-free confections. Moreover, it has applications in preparing bubble gums, vibrant food colors, ultra-sweet candies for diabetic patients, cake dressing materials, and candy gems. The slow crystallization process of Isomalt sticks gives them a smoother finish, as they can be used to prepare sugar-free delicacies for diabetics. In addition, Isomalt can be shaped into dessert candy gems or enjoyed as a tempting treat alternative to traditional sugar-based confectionaries.

The others segment is anticipated to expand at a significant growth rate during the projected period due to the increasing popularity of alternative carbohydrate sources, such as cereals and grains. These are considered staple foods due to their unique nutritional content and taste preferences, which make them popular among diet-conscious people. Changing dietary preferences toward healthier food options and the growing awareness about having whole grains in regular diets further boost the segment.

Scope of the Carbohydrates Market Report

| Report Coverage | Details |

| Carbohydrates Market Size in 2023 | USD 21.46 Billion |

| Carbohydrates Market Size by 2033 | USD 35.63 Billion |

| Carbohydrates Market CAGR | 5.2% from 2024 to 2034 |

| Carbohydrates Market Segmentation | Type, Application, Region |

| Carbohydrates Market Top Companies | Archer Daniels Midland Company, Cargill, Incorporated, Ingredion Incorporated, Bunge Limited, Tate & Lyle PLC, Grain Processing Corporation, Roquette Frères, Emsland Group, AGRANA Beteiligungs-AG, Associated British Foods plc, Sudzucker AG, The Scoular Company, AVEBE, SÜDSTÄRKE GmbH, BENEO GmbH, and Others |

Application Insights

The food & beverages segment led the carbohydrates market with the largest share in 2023. Carbohydrates are essential in the food industry since they provide essential nutrients, texture, and taste to products such as bread, pasta, cereals, and snacks. They are also used as thickeners, stabilizers, and sweeteners. Fast-releasing and slow-releasing carbohydrates are used in food preparation for their functional attributes like coating ability, viscosity, sweetness, solubility, and browning capacity. The rising demand for carbohydrate-rich snacks contributed to segmental growth.

The others segment is anticipated to grow at the fastest rate over the projected period due to its versatility in various sectors. Carbohydrates are used as a feedstock for producing ethanol. They are also used in drug formulation. Adhesives and textiles are examples of non-food applications that depend on carbs. This versatility across industries further boosts their demand in various industries.

Market Dynamics

Driver

Increasing demand for functional carbohydrates

The demand for functional carbohydrates is rising at a rapid pace due to the growing concerns about health and wellness. These carbohydrates are used in different foods and dietary supplements for their health benefits, such as immunity enhancement, weight control, healthy gut/digestive systems maintenance, and heart disease care. The rising concerns about obesity and gastrointestinal disorders are boosting the demand for dietary supplements and functional beverages enriched with carbohydrates. The increasing consumption rates of convenience meals have led to a high demand for carbohydrates, fibers, proteins, and fats in ready-to-eat or ready-to-mix/drink products. Moreover, functional carbohydrates are also used in veterinary feed ingredients, as they can improve the pet’s skin and health.

Restraint

Disorders associated with carbohydrates is major challenge

Food is transformed into energy through enzymes utilized by the body, which is termed metabolism. The inability of the body’s enzymes to convert carbohydrates to glucose leads to a type of metabolic disease called carbohydrate metabolism disorders that result in an excess sugar buildup in the body tissues, which can be dangerous. It can lead to serious health issues, with some being life-threatening. If there is a family history of these disorders, parents may undergo genetic tests to determine if they are carriers of the gene. Other genetic tests can also help to establish if either the condition is present in the fetus or whether it carries the gene for it. To conclude, metabolic disorders significantly impact how well food-derived energy is used and stored in human bodies.

Opportunity

Rising demand for specialty carbohydrates

Specialty carbohydrates are in high demand, as people are becoming aware of the health benefits of high fiber content in food. Thus, people are focusing on improving health by adding carbohydrate components, such as resistant starches, dietary fibers, and prebiotics. Such products are included in various foods and drinks, like probiotic yogurt and fortified cereals. Furthermore, nutritional supplements are an easy way to promote health. Thus, the rising demand for sports nutrition and weight loss products further fuels the market.

Recent Developments

- In September 2024, Thinkerbell launched a campaign to promote XXXX Ultra, its new Ultra zero-carb beer, reminding Aussies that beer is the only zero-carb drink worth trying.

- In May 2024, Starbucks introduced three new boba-inspired drinks, which are high in sugar and carbohydrates.

- In January 2024, British sports nutrition firm Styrkr introduced Gel50, a quick energy gel with 50g of dual carbohydrates in mixed berry and citrus fruit flavors.

- In January 2024, Carbs Fuel LLC introduced a low-priced high-carbohydrate gel, offering 50 grams per serving at US$ 2 without preservatives, gelling agents, or additives, reducing stomach troubles.

- In April 2023, a food tech business called Better Brand, Inc. introduced The Better Bagel, which reduces carbohydrates in a high-carb dish to the equivalent of ½ of an orange or 1/5th of a banana.

Carbohydrates Market Top Key Players

- Archer Daniels Midland Company

- Tate & Lyle PLC

- Cargill, Incorporated

- Roquette Frères

- Ingredion Incorporated

- Bunge Limited

- Grain Processing Corporation

- Emsland Group

- Sudzucker AG

- AGRANA Beteiligungs-AG

- AVEBE

- SÜDSTÄRKE GmbH

- Associated British Foods plc

- The Scoular Company

- BENEO GmbH

Segments Covered in the Report

By Type

- Isomalt

- Palatinose

- Curdlan

- Cyclodextrin

- Others

By Application

- Food & Beverages

- Pharmaceutical/Nutraceutical

- Cosmetics & Personal Care

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/3454

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

- Circular Economy Consulting Services Market Size to Cross USD 18.85 Bn by 2034 - April 8, 2025

- Test Benches Market Size to Attain USD 2.56 Bn by 2034 - April 8, 2025

- Second-life Electric Vehicle Batteries Market Size to Gain USD 12.42 Billion by 2034The global second-life electric vehicle batteries market size is accounted to gain around USD 12.42 billion by 2034, increasing from USD 1.27 billion in 2024, with a CAGR of 25.61%. - April 8, 2025