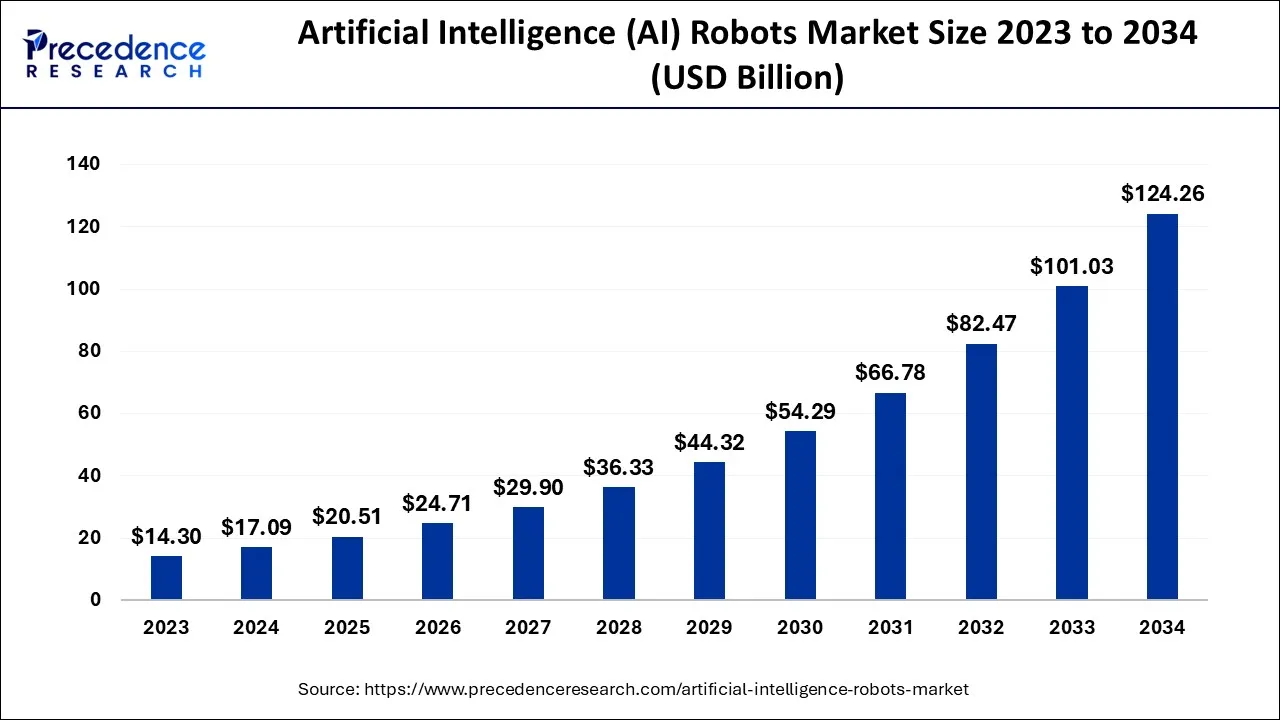

The global artificial intelligence (AI) robots market size is expected to be reach around USD 124.26 billion by 2034, increasing from USD 14.30 billion in 2023. It is expanding at a CAGR of 21.9% from 2024 to 2034.

The worldwide artificial intelligence (AI) robots market has experienced significant growth in the past few years and is expected to continue growing in the coming years due to the increasing acceptance of AI-driven technologies in industrial automation to reduce human errors.

Key Insights

- North America region has accounted revenue share of 33.12% in 2023.

- Asia-Pacific is poised to reach at a CAGR of 21.9% from 2024 to 2034.

- By offering, the services segment has generated highest revenue share of 37.14% in 2023.

- By offering, the hardware segment is expected to grow at a CAGR of 21.8% between 2024 and 2034.

- By robot type, the industrial robots segment has captured revenue share of 60.51% in 2023.

- By robot type, the service robots segment is expanding at a CAGR of 21.6% over the forecast period.

- By technology, the machine learning segment has accounted revenue share of 34.98% in 2023.

- By technology, the context awareness segment is growing at a CAGR of 21.6% from 2024 to 2034.

- By deployment mode, the cloud segment has accounted revenue share of 53.86% in 2023.

- By deployment mode, the on-premises segment is expanding at a CAGR of 21.4% between 2024 and 2034.

| Coverage of Report | Details | |

| Market Size in 2023 | USD 14.30 Billion | |

| Market Size by 2033 | USD 101.03 Billion | |

| Market CAGR | 21.9% | |

| Market Segmentation | Technology, Robot Type, Offering, Deployment Mode, Application, Region | |

| Market Top Companies | ABB, AIBrain, Inc., Alphabet, Argo AI, LLC, Blue Frog Robotics & Buddy – Emotional Robot, Brain Corporation, CloudMinds Technology Inc., DataRobot, Inc., Fanuc, Hanson Robotics Ltd., Harman International Industries, IBM Corporation, Intel Corporation, International Business Machines Corporation, Kawasaki, Microsoft Corporation, Mitsubishi, Neurala, Inc., NVIDIA Corporation, Omron, Promobot, SoftBank Corp., UB Tech Robotics, Inc., Veo Robotics, Inc., Vicarious, Xilinx, Yaskawa | |

Regional Stance

North America dominated the artificial intelligence (AI) robots market in 2023. Research and development activities, establishment of specialized institutes, and government funding for artificial intelligence projects are the major contributors behind the flourishing North American AI robots market. The increasing adoption of AI robots for public safety and transportation further contributed to region’s dominance. In addition, with the rising technological advancements, there is a strong focus on designing and developing advanced robotics, which can be intended for interaction with human beings.

The U.S. artificial intelligence (AI) robots market size was valued at USD 4.43 billion in 2023 and is expected to reach around USD 31.60 billion by 2033.

Asia Pacific is expected to register the fastest CAGR during the forecast period. The boom in AI robots, especially in countries like Japan, China, and India, is driving the market in the region. With a rise in demand for higher productivity in industrial production, robotics are being increasingly adopted. Moreover, the rising industrialization in countries like India and China is expected to contribute to market expansion in the Asia Pacific.

- In September 2024, Zen Technologies Ltd, a defense training solution firm, partnered with its subsidiary AI Turing Technologies and launched four innovative remote-controlled weapon and surveillance systems to enhancing defense capabilities.

| Region Covered | Market Share 2023 (%) | |

| North America | 33.12 | % |

| Europe | 28.84 | % |

| Asia Pacific | 25.29 | % |

| Latin America | 7.99 | % |

| MEA | 4.76 | % |

Offering Insights

The hardware segment is projected to expand at the significant growth rate in the coming years. AI refers to machines that can perform cognitive functions such as learning and thinking. AI robot hardware includes CPUs, TPUs, GPUs, FPGAs, ASICs, and NNPs. Several performance indicators, such as FLOPS, TOPS, latency, throughput, and efficiency, are significant when testing AI hardware. AI hardware’s performance is heavily dependent on the quantization techniques selected for a given application, hence ensuring high performance and applicability for AI works.

Artificial Intelligence (AI) Robots Market, By Offering 2022-2024 (USD Million)

| 2022 | 2023 | 2024 | |

| Software | 4,512.6 | 5,375.7 | 6,430.6 |

| Hardware | 2,814.4 | 3,356.5 | 4,019.8 |

| Services | 4,689.8 | 5,567.9 | 6,638.1 |

Robot Type Insights

The industrial robots segment dominated the artificial intelligence (AI) robots market with the largest share in 2023. This is primarily due to the increasing focus on industrial automation. Robots are widely used in manufacturing operations, such as fabrication, assembly, and material transfer operations. When a hazard is detected, these robots can be programmed to slow down or stop movement, enabling safe operations and protecting workers from injury. The productivity is also enhanced as they will undertake the same assignment without resting for the whole duration. They also cut down labor, raw materials, and power consumption expenses. They can be programmed to perform precise work, remove human error, and improve accuracy in welding operations. They also occupy less space and need less maintenance.

- In March 2024, Teradyne Robotics and NVIDIA partnered to bring AI capabilities in industrial robots, marking a significant leap toward artificial general robotics.

The service robot segment is anticipated to grow at a significant rate in the artificial intelligence (AI) robots market during the forecast period. Various industries are incorporating service robotics to improve the customers’ experience and the efficiency of operations. These robots are used in the healthcare, retailing, logistics, hospitality, education, and farming industries. In hospitals, sterilization robots are utilized to ensure the safety of patients and aid in carrying out the patient’s care service. In retailing, they are deployed in stores to enhance the shopping experience and help run the business more efficiently. The demand for robotic systems is on the rise in logistics businesses. These robots help to prepare orders and deliver packages to their customers. In learning institutions, for instance, robots can improve training for every individual. Service robots have a wide range of advantages, one of which is increased safety, an increase in efficiency, a decrease in expenditure, and improved accuracy.

Artificial Intelligence (AI) Robots Market, By Robot Type 2022-2024 (USD Million)

| Robot Type | 2022 | 2023 | 2024 |

| Service Robots | 4,670.6 | 5,564.9 | 6,658.2 |

| Industrial Robots | 7,346.2 | 8,735.1 | 10,430.3 |

Technology Insights

The machine learning segment dominated the artificial intelligence (AI) robots market in 2023. The advent of robotics combined with machine learning has transformed robots’ functionalities, resulting in their utilization in several fields, including inspection, maintenance, security, production, and even medical care. Machine learning algorithms improve the quality and prediction of surveillance tasks, thus increasing manufacturing efficiency and productivity. In healthcare, however, in addition to making the exact surgery or the appropriate diagnosis, these robots take on individual patient care responsibilities, considerably boosting the worth of such technology in this sphere.

Artificial Intelligence (AI) Robots Market, By Technology 2022-2024 (USD Million)

| Technology | 2022 | 2023 | 2024 |

| Machine Learning | 4,082.8 | 4,866.7 | 5,825.3 |

| Computer Vision | 2,115.1 | 2,519.9 | 3,014.8 |

| Context Awareness | 3,134.1 | 3,732.9 | 4,464.9 |

| Natural Language Processing | 2,684.8 | 3,180.5 | 3,783.4 |

Market Dynamics

Driver

High demand for robots in the healthcare sector to fuel the growth of the artificial intelligence (AI) robots market

The healthcare industry is being transformed through the implementation of AI robots in surgical procedures and patient care. For instance, Tru-D is a self-operating robot that disinfects hospital surfaces, thus preventing the risk of bacteria for both the patients and the caregivers. Moxi by Diligent Robotics supports the clinical staff by helping distribute sterile instruments, lab samples, and medicine deliveries. Futronics’ healthcare information technology ecosystem primarily focuses on patient monitoring systems or units as it provides 24-hour gathering and processing of patients’ consciousness vitals. In addition, these robots help patients with mobility. Surgical robots, like Mako by the Stryker Company, have emerged as advanced robotics, helping surgeons in hip and knee replacement surgeries.

- In September 2024, Pudu Robotics introduced the PUDU MT1, an AI-powered robotic sweeper designed for large-scale environments. This sweeper enhances cleaning efficiency and maintains high cleanliness standards.

Restraint

Ethical issues restrain the growth of the market

The role of ethics in artificial intelligence evokes much debate, primarily due to issues such as the infringement of individual privacy, the predisposition toward bias, and its societal effects. The development of AI-driven systems presents ethical issues, for example, in surveillance systems. When implementing AI across all sectors, especially the health and criminal justice systems, it is vital to concentrate on ethical principles to promote equitable results. Despite technological advancements, it is very important to provide fair and open work without violating any human rights in addressing ethical problems in artificial intelligence.

Opportunity

Technological advancements to create immense opportunities in the artificial intelligence (AI) robots market

Because of advances in machine learning and artificial intelligence, ordinary machines are now revolutionizing with advanced features. AI algorithms help robots gain the fine motor skills required to grasp objects, resulting in enhanced recognition of their surroundings, identification patterns, and data comprehension. This further enhances the robot’s autonomy and reduces maintenance.

Recent Developments in the Artificial Intelligence (AI) Robots Market

- In October 2024, WEILAN, a leading AI and robotics company, launched the upgraded BabyAlpha A2 series, a smart quadruped petbot for family companions, and the developer version, BabyAlpha DevQ, for engineers and developers worldwide.

- In August 2024, Nvidia launched a suite of services and tools at Siggraph 2024 to accelerate the development of humanoid robots, including Nvidia NIM microservices, Nvidia OSMO, and a remote-control workflow for training robots with minimal data.

- In July 2024, AI Turing Technologies and Zen Technologies introduced the Prahasta robot, a revolutionary tool for real-time 3D terrain mapping in the global defense market.

Artificial Intelligence (AI) Robots Market Top Companies

- ABB

- AIBrain, Inc.

- Alphabet

- Argo AI, LLC

- Blue Frog Robotics & Buddy – Emotional Robot

- Brain Corporation

- CloudMinds Technology Inc.

- DataRobot, Inc.

- Fanuc

- Hanson Robotics Ltd.

- Harman International Industries

- IBM Corporation

- Intel Corporation

- International Business Machines Corporation

- Kawasaki

- Microsoft Corporation

- Mitsubishi

- Neurala, Inc.

- NVIDIA Corporation

- Omron

- Promobot

- SoftBank Corp.

- UB Tech Robotics, Inc.

- Veo Robotics, Inc.

- Vicarious

- Xilinx

- Yaskawa

Market Segmentation

By Offering

- Software

- Hardware

- Services

By Robot Type

- Service Robots

- Industrial Robots

- Others

By Technology

- Machine Learning

- Computer Vision

- Context Awareness

- Natural Language Processing

By Deployment Mode

- Cloud

- On-premises

By Application

- Law Enforcement

- Road Patrol

- Riot Control

- Military & Defense

- Border Security

- Search and Rescue Operations

- Combat Operations

- Spying

- Public Relations

- Reception Robots

- Tour Guiding Robots

- Personal Assistance and Care

- Elderly Assistance Robots

- Companion Robots

- Education and Entertainment

- Research and Space exploration

- Industrial

- Agriculture

- Healthcare Assistants

- Stock Management

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

Immediate Delivery Available | Buy This Premium Research Report@https://www.precedenceresearch.com/checkout/1999

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

- Electric Ranges Market Size to Worth USD 50.29 Bn By 2034 - November 11, 2024

- Liquid Packaging Carton Market Size to Cross USD 49.17 Bn By 2034 - November 11, 2024

- Oil and Gas Security Market Size to Cross USD 47.82 Bn By 2034 - November 11, 2024