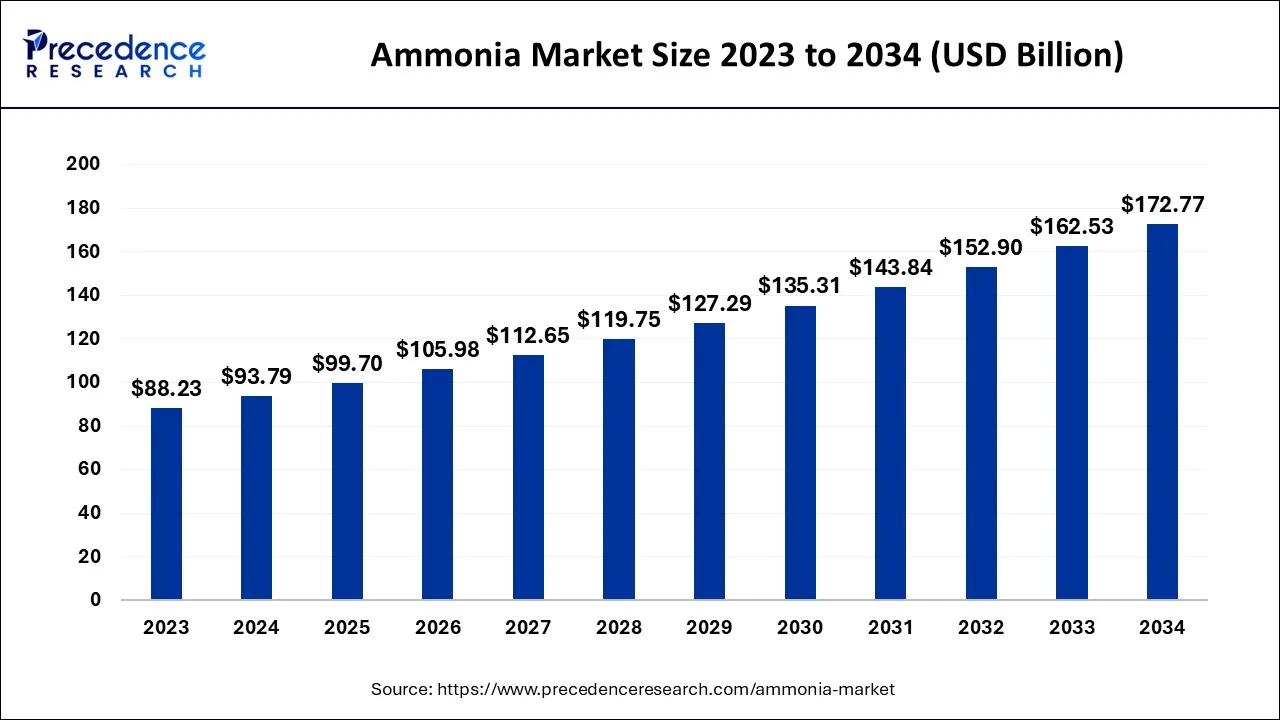

The global ammonia market size is expected to surpassed USD 172.77 billion by 2033, increasing from USD 88.23 billion in 2023. It is growing at a CAGR of 6.3% from 2024 to 2034.

Ammonia is widely used in biotechnology and pharmaceutical industries to make pharmaceuticals. The Haber-Bosch process produces it by mixing atomic hydrogen and nitrogen. The rising usage of ammonia to produce fertilizers boosts the market. It is used as a base material for fertilizers as it binds air-borne nitrogen and produces the most critical crop nutrient, nitrogen. Ammonia is also used widely in the textile industry. It is used in the finishing of cotton-containing materials and as a dye.

Report is Easily Accessible | Request a Sample Copy of the Report@ https://www.precedenceresearch.com/sample/2420

Key Insights

- North America has generated highest revenue share of around 37.79% in 2023.

- Asia Pacific has captured revenue share of around 23.99% in 2023.

- By application, the bio-pharmacy segment has generated highest revenue share of 41.73% in 2023.

- The bio-industries application segment has captured revenue share of 24.33% in 2023.

- By technology, the tissue engineering and regeneration segment has accounted revenue share of 19.26% in 2023.

| Report Coverage | Details |

| Market Size in 2023 | USD 88.23 Billion |

| Forecasted Value (2034) | USD 172.77 Billion |

| Projected CAGR | 6.3% from 2024 to 2034 |

| Top Companies | Achema AB, ACME Group, ACRON, Acron, AquaHydrex, BASF SE, CF Industries Holdings Inc., China Petroleum & Chemical Corporation, Electrochaea, Enter, ENGIE, EuroChem Group AG, EXTRON, Fertiglobe plc, Green Hydrogen Systems, Greenfield Nitrogen LLC, Group DF, Haifa Chemicals Ltd., Haldor Topsoe, Helm AG, Hiringa Energy, Honeywell International, Hydrogenics, Incitec Pivot Ltd, Indian Farmers Fertiliser Cooperative Limited, and Other |

Asia Pacific Dominated the Ammonia Market

Asia Pacific dominated the ammonia market in 2023. This is mainly due to the rising demand for agricultural goods. India, China, and Indonesia are the leading countries in the regional market. China is the largest producer and consumer of ammonia, accounting for over 50% of the market share in Asia Pacific. With the rising farming practices in countries like India, there is a high demand for fertilizers, thus contributing to market growth. In addition, increasing initiatives to boost ammonia production fuels the market growth in the region.

- In October 2024, the Central Transmission Utility of India announced a plan to establish an interstate transmission system network for 19,500 MW renewable energy by FY30, serving green hydrogen and ammonia manufacturing plants in Gujarat, Tamil Nadu, and Andhra Pradesh.

- In September 2024, Uttar Pradesh set a goal to produce 1 million metric tons of Green Hydrogen and Green Ammonia annually by 2029, with investment proposals worth ₹1.15 lakh crore and 20,000 job creations.

North America is expected to grow at a significant growth rate

The ammonia market in North America is expected to grow at a significant rate during the forecast period. The demand for ammonia in the U.S. correlates with the expansion of finished sectors in the region, most notably the agricultural sector. A population increase coupled with greater agricultural productivity implies a corresponding increase in fertilizer use. The U.S. ranks among the top ammonia-producing countries, where it is used to make synthetic textiles, polymers, resins, and other chemicals. Rising industrial production further contributes to market expansion. Regional players are investing heavily in research & development and manufacturing technologies to boost ammonia production.

Product Insights

The liquid segment dominated the market in 2023. Fertilizer-grade dehydrated ammonia is a highly compressed, colorless, and odorous gas-liquid. In addition, liquid ammonia has applications in industrial cleaning services and in synthesizing some substances. Liquid ammonia is often employed as a solvent in the preparation of fertilizers, plastics, and artificial threads, owing to its property to dissolve in organic solvents. In addition, the distinct chemical characteristics of the compound render it useful in cleaning processes in the pharmaceutical industry. It is a suitable cleaning agent because it can dissolve grease and oils. The diversity of its application makes it a favorable option for several industries. Ongoing studies and improvements underline its efficacy for prospective uses.

Application Insights

The fertilizers segment led the ammonia market in 2023. Anhydrous ammonia, a colorless gas that is a highly concentrated nitrogen source, is widely used in agriculture as it is mainly considered cheap and has a rich nutrient value. Plants quickly take up and transform this compound ammonia into a nitrate form, allowing healthy growth of the crops. It reduces dependence on the overuse of nitrogenous fertilizers, and the emission of greenhouse gases is quite low. Because of its rich nutrient profile and high efficiency, it contributes to high crop production with low input costs. Ammonia can be found in anhydrous ammonia, ammonium nitrate, urea, and ammonium sulfate. Means of application include direct injection, broadcast application, and fertigation.

Market Dynamics

Driver

Wide range of application to drive the growth of the ammonia market

Ammonia is the second most widely produced commodity after cement and has applications in agriculture, domestic cleaning materials, metal finishing, and even oil. Ammonia performs many functions in many industries, including but not limited to being an odor control agent in waste treatment, leather, rubber and paper production, food and drink, cold and medicinal storage, ice-making refrigeration systems, drug manufacture, printing drugs, beauty products and in the process of fermenting foods. For agriculture, it is also used as an important base material in fertilizers. Ammonia is also used as a cleaning agent. In treating metals, an atmosphere of dissociated ammonia is also applied to processes such as storage-assertively, carbo nitrogen hardening, and hydrogen welding. Furthermore, the rising production of ammonia boosts the market growth.

Restraint

Toxicity challenges hamper the growth of the ammonia market

Both ammonia and ammonium hydroxide are corrosive materials with serious health consequences. Short-term exposure may lead to irritation of the upper respiratory system and its associated structures, while exposure via the mouth may lead to pains, severe drooling, and burning injuries of the mouth and throat. Moderate levels of exposure may cause destruction within the oral cavity, nasal airway, voice box, difficulty breathing, and swelling in the lungs and bronchi. Ammonia does not reveal any structural alerts indicating the likelihood of DNA reactivity, and it is not listed among substances known or suspected of causing cancer in humans or animals.

Opportunity

Technological advancements

The process of industrial-done ammonia synthesis consumes 1.8% of the world’s energy supply and releases roughly 500 million tons of CO2 emissions. Therefore, energy-efficient strategies are greatly needed in the current world. Due to the lower cost of iron-potassium oxide catalysts, 80% of the ammonia produced using the Haber-Bosch process is used in the production of fertilizers. More expensive catalysts such as Ru ones are, however, more active. On the other hand, thermal, electrochemical, photocatalytic ammonia synthesis, and electrolysis ammonia synthesis are technologies that have developed recently. However, these processes still need to be fine-tuned to achieve more sustainable and effective practices.

Recent Developments in the Ammonia Market

- In October 2024, Yara International opened a new ammonia import terminal in Brunsbüttel, Germany, allowing annual import of up to three million tons of low-emission ammonia to Europe.

- In October 2024, Evonik and BASF signed an agreement to deliver BASF’s ammonia BMBcert grade, demonstrating their commitment to reducing their carbon footprint.

- In September 2024, McDermott and BW Offshore partnered to enhance offshore blue ammonia production, promote low-carbon energy transition and sustainable practices, and contribute to the global energy transition.

- In August 2024, Topsoe, Skovgaard Energy, and Vestas inaugurated a green ammonia plant in Denmark. The plant will utilize renewable energy for efficient production and cost-effectiveness, contributing to net-zero emissions.

Ammonia Market Companies

- Achema AB

- ACME Group

- ACRON

- Acron (Russia)

- AquaHydrex (US)

- BASF SE (Germany)

- CF Industries Holdings Inc. (US)

- China Petroleum & Chemical Corporation

- Electrochaea (Germany)

- Enter (Italy)

- ENGIE (France)

- EuroChem Group AG (Switzerland)

- EXTRON (Germany)

- Fertiglobe plc

- Green Hydrogen Systems (Denmark)

- Greenfield Nitrogen LLC

- Group DF (Ukraine)

- Haifa Chemicals Ltd.

- Haldor Topsoe (Denmark)

- Helm AG

- Hiringa Energy (New Zealand)

- Honeywell International

- Hydrogenics (Canada)

- Incitec Pivot Ltd

- Indian Farmers Fertiliser Cooperative Limited (India)

- ITM Power (UK)

- Jiangsu Huachang Chemical Co. Ltd.

- Koch Fertilizer, LLC (US)

- Linde Group

- Maire Tecnimont S.p.A.

- MAN, Energy Solutions (Germany)

- McPhy Energy (France)

- Mitsubishi Gas Chemical Co., Ltd.

- Nel Hydrogen (Norway)

- Nutrien Ltd. (Canada)

- OCI NV (Netherlands)

- Orica Limited (Australia)

- Ostchem Holding

- Potash Corp

- Praxair, Inc.

- Qatar Fertiliser Company (Qatar)

- Queensland Nitrates Pty Ltd (Australia)

- SABIC (Saudi Arabia)

- Siemens Energy (Germany)

- Starfire Energy (US)

- Sumitomo Chemical

- The Dow Chemical Company

- ThyssenKrupp AG (Germany)

- Togliattiazot (Russia)

- Trammo Inc

- Ube Industries

- Uniper (Germany)

- Uralchem JSC (Russia)

- Yara International (Norway)

Segments Covered in the Report

By Product Form

- Liquid

- Gas

- Powder

By Application

- Fertilizers

- Refrigerants

- Pharmaceuticals

- Textile

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/2420

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

- Singapore Interactive Kiosk Market Size to Attain USD 1,835.92 Billion by 2034 - April 17, 2025

- Robotic Sensors Market Size to Attain USD 1,716.86 Million by 2034 - April 17, 2025

- Laminated Steel Market Size to Reach USD 2.63 Billion by 2034 - April 17, 2025