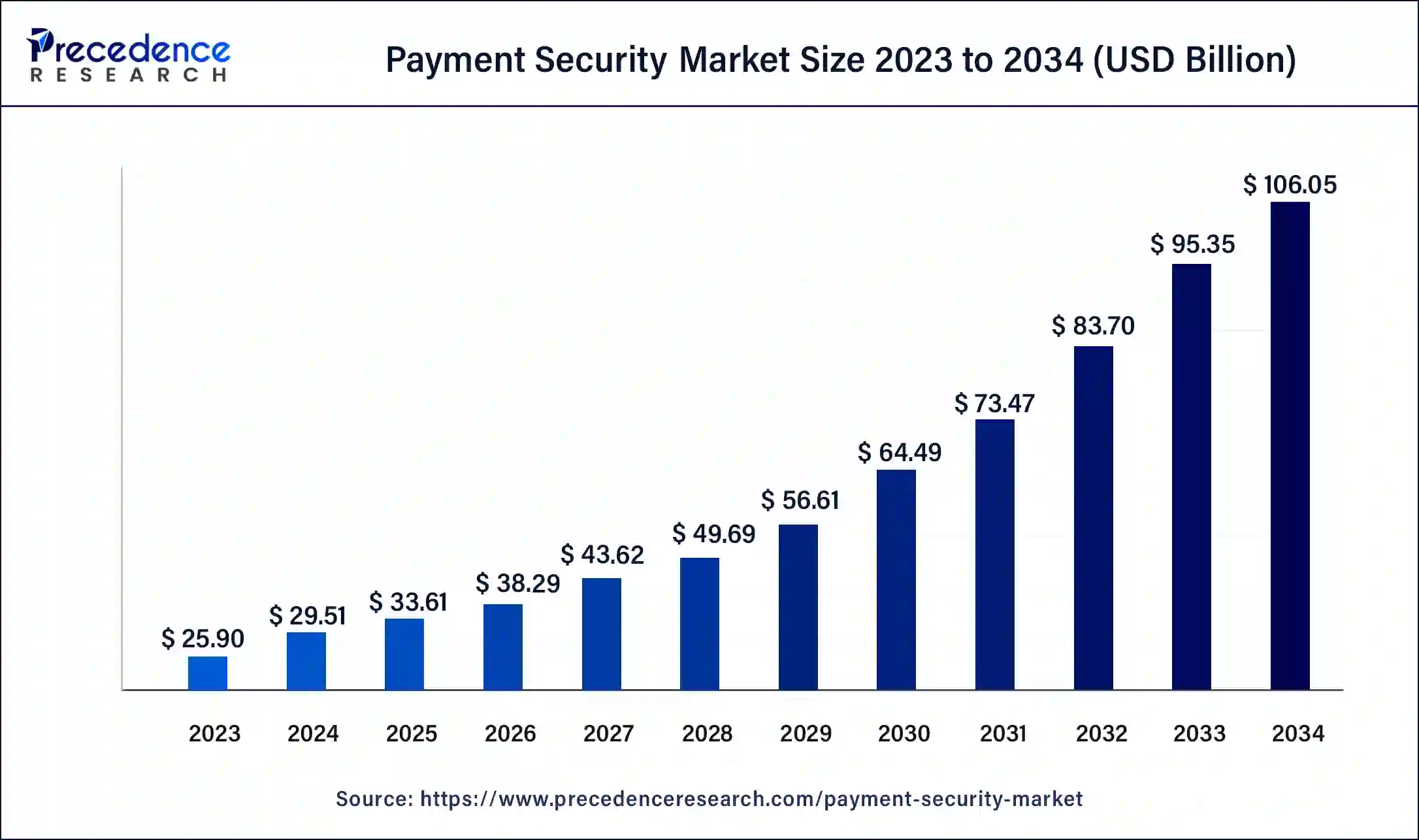

The global payment security market size was calculated at USD 25.90 billion in 2023 and is expected to expand around USD 95.35 billion by 2033, growing at a CAGR of 13.92% from 2024 to 2033.

Key Points

- The North America payment security market size accounted for USD 9.32 billion in 2023 and is expected to attain around USD 34.80 billion by 2033, poised to grow at a CAGR of 14.08% between 2024 and 2033.

- North America dominated the market with the largest revenue share of 36% in 2023.

- Asia Pacific is the fastest-growing region in the market.

- By solution, the fraud detection & prevention segment has held the biggest revenue share of 53% in 2023.

- By solution, the tokenization segment is expected to register significant growth over the projected period.

- By platform, the PoS-based/mobile-based segment has generated more than 59% of revenue share in 2023.

- By platform, the web-based segment is expected to grow at a significant rate during the forecast period.

- By organization, the large enterprises segment has contributed more than 69% of revenue share in 2023.

- By organization, the small & medium-sized enterprises (SMEs) segment is expected to register significant growth during the forecast period.

- By application, the retail & e-commerce segment accounted more than 28% of revenue share in 2023.

- By application, the education segment shows significant growth during the forecast period.

The Payment Security Market refers to the collection of technologies and practices designed to protect financial transactions and sensitive payment information from fraud, theft, and other cyber threats. This market encompasses a wide range of solutions, including encryption, tokenization, fraud detection and prevention systems, secure payment gateways, and compliance management tools. The increasing volume of online transactions, driven by the growth of e-commerce and digital banking, has heightened the need for robust payment security measures. As cybercriminals develop more sophisticated methods to breach payment systems, businesses and consumers alike prioritize payment security to safeguard their financial data.

Get a Sample: https://www.precedenceresearch.com/sample/4360

Growth Factors

Several factors contribute to the growth of the Payment Security Market. The rapid expansion of e-commerce and online shopping platforms is a primary driver, necessitating advanced security solutions to protect millions of daily transactions. Additionally, the proliferation of mobile payment technologies and digital wallets has increased the need for secure payment infrastructures. Regulatory frameworks such as the Payment Card Industry Data Security Standard (PCI DSS) also drive the adoption of security solutions by mandating strict compliance requirements for businesses handling card payments. The rising awareness of cyber threats and data breaches further fuels the demand for comprehensive payment security measures.

Regional Insights

The Payment Security Market exhibits significant regional variations in terms of adoption and growth. North America holds a dominant position due to its advanced technological infrastructure, high internet penetration rates, and strong regulatory environment. Europe follows closely, driven by stringent data protection laws such as GDPR and a robust e-commerce sector. The Asia-Pacific region is witnessing rapid growth, fueled by increasing internet connectivity, booming e-commerce markets, and the adoption of digital payment methods in countries like China and India. Latin America and the Middle East & Africa are also emerging markets, with growing awareness and investments in payment security technologies.

Payment Security Market Scope

| Report Coverage | Details |

| Payment Security Market Size in 2023 | USD 25.90 Billion |

| Payment Security Market Size in 2024 | USD 29.51Billion |

| Payment Security Market Size by 2033 | USD 95.35 Billion |

| Payment Security Market Growth Rate | CAGR of 13.92% from 2024 to 2033 |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Solution, Platform, Organization, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Payment Security Market Dynamics

Drivers

The primary drivers of the Payment Security Market include the exponential growth of digital commerce and online transactions, which necessitate advanced security measures to prevent fraud and data breaches. Regulatory compliance requirements, such as PCI DSS and GDPR, compel businesses to adopt stringent security protocols. The increasing frequency and sophistication of cyber-attacks also drive the need for robust payment security solutions. Additionally, consumer demand for secure payment methods and the growing popularity of mobile and digital wallets further propel market growth.

Opportunities

The Payment Security Market presents numerous opportunities for innovation and expansion. The rise of artificial intelligence (AI) and machine learning offers new avenues for developing sophisticated fraud detection and prevention systems. Blockchain technology holds potential for enhancing transaction security and transparency. The increasing adoption of Internet of Things (IoT) devices in financial transactions opens up new markets for security solutions tailored to these technologies. Furthermore, the expansion of e-commerce into emerging markets provides significant growth potential for payment security providers.

Challenges

Despite its growth prospects, the Payment Security Market faces several challenges. The constantly evolving nature of cyber threats requires continuous innovation and adaptation, which can be resource-intensive. Ensuring compliance with diverse and ever-changing regulatory standards across different regions can be complex and costly for businesses. Additionally, integrating new security technologies with existing payment infrastructures can pose technical challenges. There is also a need to balance security with user experience, as overly stringent security measures may hinder transaction convenience and customer satisfaction.

Read Also: Personal Mobility Devices Market Size, Share, Report by 2033

Payment Security Market Recent Developments

- In March 2023, Paytech Ingenico announced the acquisition of software-based POS solutions provider Phos, extending its offering for merchant payment acceptance via smartphone, where payment security is mainly focused. As per the information detailed in the press release, the strategic purchase of Phos marks an additional step in Ingenico’s evolution toward software-driven services.

- In July 2022, TokenEx, a cloud tokenization and payment optimization provider, collaborated with Visa, a prominent digital payment solutions provider, to become an authorized cloud-based network tokenization partner for Visa. As part of its partnership with Visa, TokenEx selected Token ID, a solution that caters to regional payment systems, financial institutions, merchants, clearinghouses, and various stakeholders within the payment ecosystem.

- In June 2022, Ingenico ePayments, Worldline appointed Nigel Lee as APAC Senior Vice President for the Terminals, Solutions & Services Global Business Line.

Payment Security Market Companies

- Elavon Inc.

- Ingenico

- Utimaco Management GmbH

- Shift4 Payments Inc.

- Mastercard

- Intelligent Payment Solutions Pvt Ltd.

- TokenEx, LLC

- Paypal Holdings, Inc.

- Bluefin Payment Systems

- Visa Inc.

Segments Covered in the Report

By Solution

- Encryption

- Tokenization

- Fraud Detection & Prevention

By Platform

- Web-based

- PoS based/Mobile based

By Organization

- Small & Medium-Sized Enterprises (SMEs)

- Large Enterprises

By Application

- Retail & E-commerce

- Travel & Hospitality

- Healthcare

- Telecom & IT

- Education

- Media & Entertainment

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/

- Intelligent Traffic Management System Market Size, Trends, Report 2034 - July 17, 2024

- Healthcare Finance Solutions Market Size to Grow USD 293.12 Bn by 2034 - July 17, 2024

- Epoxy Composites Market Size to Grow USD 84.99 Bn by 2034 - July 17, 2024