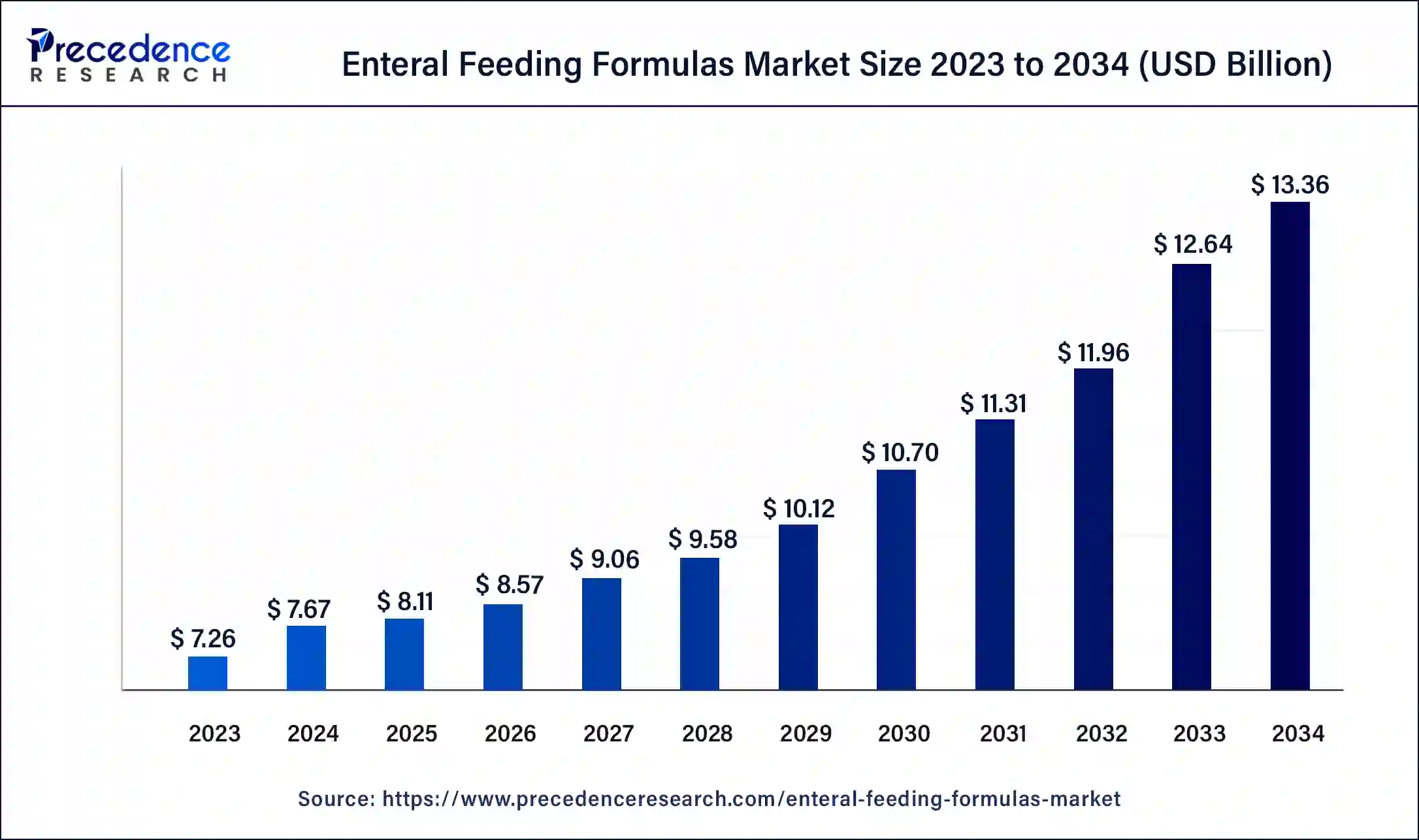

The global enteral feeding formulas market size was estimated at USD 7.26 billion in 2023, growing at a CAGR of 5.59% from 2024 to 2033. The enteral feeding formulas market encompasses a variety of nutritional formulas designed for patients who cannot consume food orally and require enteral feeding through tubes directly into the stomach or intestines. These formulas are specially tailored to meet the nutritional needs of patients with various medical conditions, such as gastrointestinal disorders, cancer, neurological disorders, and malnutrition. The market has seen significant growth due to increasing awareness of the benefits of enteral nutrition and advancements in formula compositions.

Key Points

- The North America enteral feeding formulas market size was estimated at USD 2.32 billion in 2023 and is expected to surpass around USD 4 billion by 2033.

- North America held the largest market share of 32% in 2023.

- By product, the standard formula segment dominated the market with the largest market share of 58% in 2023.

- By flow type, intermittent feeding flow segment has captured the largest market share of 90% in 2023.

- By stage, the adult segment has accounted for the largest share of 91% in 2023.

- By indication, the cancer care segment held a significant share of the market in 2023.

- By sales channel, the institutional segments dominated the market with the highest market share of 52% in 2023.

- By end use, the home care segment is expected to grow at the fastest CAGR of 5.92% over the forecast period.

Growth Factors

The growth of the enteral feeding formulas market is driven by several key factors. First, the rising prevalence of chronic diseases such as cancer, diabetes, and neurological disorders has increased the demand for enteral feeding solutions. Additionally, the aging population worldwide has contributed to a higher incidence of conditions requiring enteral feeding. Technological advancements in formula composition, including specialized formulations for specific medical needs, have also fueled market growth. Further, healthcare professionals’ growing preference for enteral feeding over parenteral feeding due to its cost-effectiveness and lower risk of complications has boosted market demand.

Get a Sample: https://www.precedenceresearch.com/sample/4123

Region Insights

Regionally, North America dominates the enteral feeding formulas market due to its advanced healthcare infrastructure, high healthcare spending, and large aging population. Europe follows closely, driven by an increase in the elderly population and a well-established healthcare system. Asia-Pacific is expected to witness substantial growth due to the rising prevalence of chronic diseases, improving healthcare infrastructure, and growing awareness of enteral feeding benefits. Emerging economies like China and India offer significant growth opportunities due to their large population base and increasing healthcare investments.

Enteral Feeding Formulas Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 5.59% |

| Global Market Size in 2023 | USD 7.26 Billion |

| Global Market Size in 2024 | USD 7.67 Billion |

| Global Market Size by 2033 | USD 12.51 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Flow Type, By Stage, By Indication, By End-use, and By Sales Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Enteral Feeding Formulas Market Dynamics

Drivers

Key drivers of the enteral feeding formulas market include:

- Increasing prevalence of chronic diseases and conditions requiring enteral feeding.

- Technological advancements leading to the development of specialized formulas.

- Growing awareness among healthcare professionals and patients about the benefits of enteral nutrition.

- Rising geriatric population worldwide, which often necessitates enteral feeding.

Opportunities

The enteral feeding formulas market presents several opportunities for growth:

- Development of customized and specialized formulas tailored to specific patient needs.

- Expansion into emerging markets with increasing healthcare investments and growing populations.

- Integration of digital health solutions, such as remote patient monitoring, to improve patient outcomes and compliance.

- Collaborations with healthcare providers and organizations to educate patients and professionals about the benefits of enteral feeding.

Challenges

Despite the positive outlook, the enteral feeding formulas market faces some challenges:

- High costs associated with enteral feeding devices and formulas, which may limit accessibility for some patients.

- Stringent regulatory requirements for the development and approval of enteral feeding formulas.

- The potential risk of infections and complications associated with tube feeding.

- Competition from alternative nutritional products and therapies, such as parenteral feeding.

Read Also: Dental Compressors Market Size to Attain USD 620.95 Mn by 2033

Enteral Feeding Formulas Market Recent Developments

- In September 2023, Abbott announced the plan to boost the manufacturing of various adult enteral formulas for the retail market to counteract low supply in the institutional sector.

- In February 2023, Nestlé and EraCal Therapeutics initiated a research collaboration to identify novel nutraceuticals for controlling food intake.

- In September 2022, Kate Farms introduced Adult Standard 1.4, a high-calorie medical formula now offered in chocolate. This product is designed to assist in weight gain, weight maintenance, and improved tolerance while providing a delicious taste.

- In September 2022, Kate Farms raised $75 million in a Series C funding round led by life-science investor Novo Holdings. With this, Kate Farms will be able to increase its efforts in developing plant-based clinical nutrition research, product innovation, and development into more channels.

Enteral Feeding Formulas Market Companies

- Nestlé S.A.

- Abbott Laboratories

- Mead Johnson Nutrition Company

- Fresenius Kabi AG

- Danone S.A.

- Victus Inc.

- Hormel Foods, LLC

- B. Braun Melsungen AG

- Global Health Product Inc.

- Aveanna Healthcare

- Meiji Holdings Co., Ltd.

- Nutricia

Segments Covered in the Report

By Product

- Standard Formula

- Disease-specific Formulas

- Alzheimer’s

- Nutrition Deficiency

- Cancer Care

- Diabetes

- Chronic Kidney Diseases

- Orphan Diseases

- Dysphagia

- Pain Management

- Malabsorption/GI Disorder/Diarrhea

- Others

By Flow Type

- Intermittent Feeding Flow

- Continuous Feeding Flow

By Stage

- Adults

- Pediatrics

By Indication

- Alzheimer’s

- Nutrition Deficiency

- Cancer Care

- Diabetes

- Chronic Kidney Diseases

- Orphan Diseases

- Dysphagia

- Pain Management

- Malabsorption/GI Disorder/Diarrhea

- Others

By End-use

- Hospitals

- Cardiology

- Neurology

- Critical Care (ICU)

- Oncology

- Others

- Home Care

- Long-Term Care Facilities

By Sales Channel

- Online Sales

- Retail Sales

- Institutional Sales

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/

- Intelligent Traffic Management System Market Size, Trends, Report 2034 - July 17, 2024

- Healthcare Finance Solutions Market Size to Grow USD 293.12 Bn by 2034 - July 17, 2024

- Epoxy Composites Market Size to Grow USD 84.99 Bn by 2034 - July 17, 2024